Sara Lee 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the original arbitrator’s judgment against the defendants, including

the corporation. The respective motions for reconsideration have

been fully briefed by the parties and we await the NLRC’s rulings.

The corporation’s request to the Court of Appeals to reconsider

its decision to require that the bond related to the arbitrator’s

original ruling be set at approximately $23 has been denied. On

December 10, 2007, the corporation petitioned the Supreme Court

for review, arguing, among other things, that the appellate court’s

decision is now moot in light of the December 19, 2006 ruling by

the NLRC setting aside the underlying judgment. No additional bond

posting is required until all allowable appeals have been exhausted.

On March 24, 2008, the Supreme Court issued a resolution requir-

ing all parties to file comments on their respective petitions. The

corporation has filed its comments on the aforementioned petition

and is now awaiting the Supreme Court’s decision as to whether it

will accept the corporation’s petition for review. The Supreme Court

will now determine whether to give due course to the petitions and

if due course is denied, the petitions will be dismissed. Otherwise,

the Supreme Court will then require the petitioners to file their reply

and thereafter, the parties will be required to file simultaneous mem-

oranda within a specified time. This process may take from three to

twelve months. The corporation continues to believe that the plain-

tiffs’ claims are without merit; however, it is reasonably possible that

this case will be ruled against the corporation and have a material

adverse impact on the corporation’s financial position, results of

operations or cash flows.

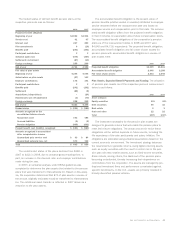

American Bakers Association (ABA) Retirement Plan

The corporation

is a participating employer in the American Bakers Association

Retirement Plan. In 1979, the Pension Benefit Guaranty Corporation

(PBGC) determined that the ABA plan was an aggregate of single-

employer pension plans rather than a multi-employer plan. Under

the express terms of the ABA plan’s governing documents, the

corporation’s contributions can only be used to pay for the benefits

of its own employee-participants. Based upon the PBGC determina-

tion and the advice of counsel, the corporation has recognized its

obligations under the plan as if it participated in a single-employer

defined benefit plan under the provisions of Statement of Financial

Accounting Standards No. 87, “Employers Accounting for Pensions.”

In August 2006, the PBGC rescinded its 1979 determination

and concluded that the ABA plan was a multi-employer plan in which

the participating parties share in the plan underfunding. The other

major participant in the ABA plan is a bankrupt third party that is

seeking an injunction to enforce the PBGC determination made in

August 2006. If the ABA plan were declared to be a multi-employer

pension plan, this third party would successfully reduce its under-

funded liability under the ABA plan by roughly $80. The corporation

has initiated litigation seeking to overturn the August 2006 PBGC

determination and intends to vigorously defend the position that

it is responsible only for the obligations related to its current

and former employees.

In February 2008, the bankrupt third party filed a motion to

reject certain of its collective bargaining agreements related to the

ABA plan, in which the third party seeks permission from the bank-

ruptcy court to reopen these agreements and reject any obligations

to continue participation in the ABA plan. Through this motion, the

third party seeks to discharge its underfunding obligations under

the ABA Plan as if the Plan were a multi- employer plan, limiting

its potential liabilities through the bankruptcy to approximately $10.

The corporation has worked with the ABA Plan to object to this

motion, and the relevant unions have also objected to this motion.

A hearing on the motion and the reorganization plan has been con-

tinued until October 1, 2008. In addition, in April 2008, the third

party notified the ABA Plan that it intended to cease contributions

to the ABA Plan for its non-union active employee participants. This

decision is further evidence of the third party’s intent to withdraw

fully from the ABA Plan. The corporation continues to believe that

the PBGC’s August 2006 determination is without merit; however,

it is reasonably possible that this case will be ruled against the

corporation and have a material adverse impact on the corpora-

tion’s financial position, results of operations or cash flows.

Multi-Employer Pension Plans

The corporation participates in

multi-employer pension plans that provide retirement benefits to

employees covered by certain collective bargaining agreements and

certain of these plans have unfunded vested benefits. Under the

Multi-employer Pension Plan Amendments Act, a cessation of contri-

butions to a multi-employer pension fund, which has unfunded

vested benefits, and a series of other factors could result in a ter-

mination, withdrawal or significant partial withdrawal, which could

render us liable for our proportionate share of the unfunded vested

benefits and may require the recognition of a liability. The corpora-

tion has been contacted by one of the multi-employer pension funds

regarding a prior plant closing and at the present time no assessment

has been made by the fund. However, it is reasonably possible an

assessment may be made in the future although we cannot esti-

mate what the potential loss may be at this time. If an assessment

is made by the fund, the corporation intends to dispute the matter,

but would be required to pay the assessment amount under ERISA

rules while the dispute is resolved. No assurances can be given

that this matter will not have a material impact on the corporation’s

financial position, results of operations or cash flows.

Purchase Commitments During 2007, the corporation exited a U.S.

meat production plant that included a hog slaughtering operation.

Certain purchase contracts for the purchase of live hogs at this

facility were not exited or transferred after the closure of the facility.

However, the corporation has entered into a hog sales contract under

which these hogs will be sold to another slaughter operator. The

majority of these purchase commitments expire by December 2009

and, using hog pricing at June 28, 2008, the corporation has approx-

imately $158 of commitments remaining under these contracts.

Sara Lee Corporation and Subsidiaries 65