Sara Lee 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review

26 Sara Lee Corporation and Subsidiaries

2008 versus 2007

Net sales in 2008 increased $249 million, or

12.2%. The impact of changes in foreign currency exchange rates

increased reported net sales by $197 million, or 9.9%, primarily due

to the strengthening of the European euro, Indian rupee, Danish

krone and the British pound. The 2008 net sales includes $2 million

from an acquisition made after the start of 2007, which increased

net sales by 0.1%. The remaining net sales increase of $50 million,

or 2.2%, was due to higher unit volumes, partially offset by increased

trade promotions related to new product launches and competitive

market pressures. Unit volumes for the four core categories – shoe

care, body care, air care and insecticides – increased 4.6%, primarily

as a result of increased volumes in body care products driven by

promotional activities and air care products due to the continuing

success of new products, partially offset by a decline in insecticide

volumes due to unfavorable weather conditions in Europe.

Operating segment income in 2008 increased $43 million,

or 15.7%. Changes in foreign currency exchange rates increased

operating segment income by $24 million, or 8.9%. The net change

in exit activities, asset and business dispositions, transformation

charges and an impairment charge increased operating segment

income by $10 million, or 3.8%. The 2008 results include $1 mil-

lion of losses from an acquisition made after the start of 2007.

The remaining operating segment income increase of $10 million,

or 3.3%, was due to the higher unit volumes and savings from con-

tinuous improvement initiatives, partially offset by an increase in

trade promotions, higher SG&A costs due to higher labor costs,

an $8 million charge for legal matters and higher commodity

and packaging costs.

2007 versus 2006

Net sales increased $215 million, or 11.8%

in 2007. The impact of changes in foreign currency exchange rates,

primarily the European euro and British pound sterling, increased

net sales by $102 million, or 5.9%. The impact of acquisitions, net of

product lines that had been disposed of after the start of 2006

increased net sales by $7 million, or 0.4%. The remaining net sales

increase of $106 million, or 5.5%, was due to higher unit volumes and

an improved product mix. Unit volumes for the four core categories

increased 5.6% in 2007, driven primarily by strong unit volume growth

for insecticides, body care and air care products. Insecticide volumes

grew due to strength in India and Europe. Body care unit volumes

increases were driven by strong volumes across this core category

particularly in deodorants and bath and shower products. Air care

volumes increased behind new product introductions.

Operating segment income increased $56 million, or 25.7%,

in 2007. Changes in foreign currency exchange rates increased

operating segment income by $11 million, or 5.2%. The change in

transformation charges, exit activities, an impairment charge, and

accelerated depreciation between 2006 and 2007 increased oper-

ating segment income by $11 million, or 7.7%, in 2007. Acquisitions

reduced operating segment income by $1 million, or 0.5%. The remain-

ing operating segment income increased by $35 million, or 13.3%,

due to an increase in unit volumes, the favorable impact of cost

saving initiatives and a reduction in pension costs, partially offset

by higher media advertising and promotion to support new products.

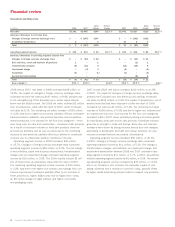

Household and Body Care

Dollar Percent Dollar Percent

In millions 2008 2007 Change Change 2007 2006 Change Change

Net sales $2,291 $2,042 $249 12.2 % $2,042 $1,827 $215 11.8 %

Increase/(decrease) in net sales from

Changes in foreign currency exchange rates $÷÷÷«– $÷(197) $197 $÷÷÷«– $÷(102) $102

Acquisition/dispositions 2–2 1037

Total $÷÷÷«2 $÷(197) $199 $÷÷«10 $÷÷(99) $109

Operating segment income $÷«315 $÷«272 $÷43 15.7 % $÷«272 $÷«216 $÷56 25.7 %

Increase/(decrease) in operating segment income from

Changes in foreign currency exchange rates $÷÷÷«– $÷÷(24) $÷24 $÷÷÷«– $÷÷(11) $÷11

Exit activities, asset and business dispositions 1–1 –(1)1

Transformation charges (8) (13) 5 (13) (19) 6

Impairment charge – (4) 4 (4) – (4)

Acquisition (1) – (1) (1) – (1)

Accelerated depreciation ––– –(8)8

Total $÷÷÷(8) $÷÷(41) $÷33 $÷÷(18) $÷÷(39) $÷21

Gross margin % 49.4 % 49.8 % (0.4) % 49.8 % 49.9 % (0.1) %