Sara Lee 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

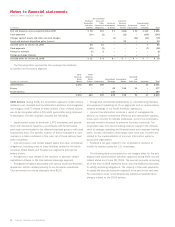

Notes to financial statements

Dollars in millions except per share data

The nature of the costs incurred under actions initiated in 2008

and the long-term transformation plan includes the following:

Exit Activities, Asset and Business Disposition Actions

These amounts primarily relate to:

•Employee termination costs

•Lease exit costs

•Gains or losses on the disposition of assets or asset

groupings that do not qualify as discontinued operations

Transformation Costs

These amounts primarily relate to:

•Expenses associated with the installation of new information

systems, including the amortization of capitalized software costs

•Costs to retain and relocate employees, as well as costs

to recruit new employees

•Consulting costs

•Accelerated depreciation and amortization associated with

decisions to dispose of or abandon the use of certain tangible

and intangible assets at dates earlier than previously anticipated,

pursuant to an exit plan. Accelerated depreciation represents the

incremental impact of the revised estimate of remaining deprecia-

tion expense in excess of the original depreciation expense.

Transformation costs do not qualify for treatment as an exit activity

or asset and business disposition under Statement of Financial

Accounting Standards No. 146, “Accounting for Costs Associated with

Exit or Disposal Activities.” However, management believes that the

disclosure of these transformation related charges provides the reader

with greater transparency to the total cost of the transformation plan.

The following is a summary of the (income) expense associated

with new and ongoing actions, which also highlights where the

costs are reflected in the Consolidated Statements of Income

along with the impact on diluted EPS from continuing operations:

In millions 2008 2007 2006

Cost of sales

Accelerated depreciation $«««««1 $«««31 $«««30

Transformation charges 810 5

Selling, general and administrative expenses

Accelerated depreciation –19

Transformation charges 43 109 154

Vacation policy change – – (14)

Net charges for (income from)

Exit activities 39 106 166

Asset and business dispositions (1) (12) (80)

Reduction in income from continuing

operations before income taxes 90 245 270

Income tax benefit (31) (89) (91)

Reduction in income

from continuing operations $«««59 $«156 $«179

Impact on diluted EPS from

continuing operations $0.08 $0.21 $0.23

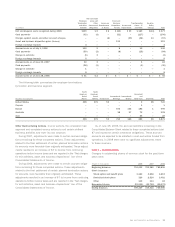

The impact of these actions on the corporation’s business seg-

ments and unallocated corporate expenses is summarized as follows:

In millions 2008 2007 2006

North American Retail Meats $13 $««78 $««48

North American Retail Bakery 43229

Foodservice 51116

International Beverage 15 21 16

International Bakery 91830

Household and Body Care 71328

Decrease in business segment income 53 173 167

Increase in general corporate expenses 37 72 103

Total $90 $245 $270

The following discussion provides information concerning the exit,

disposal and transformation activities for each year where actions

were initiated.

2008 Actions During 2008, the corporation approved certain actions

related to exit, disposal and transformation activities and recognized

net charges of $90 related to these actions. Each of these activities

are to be completed within a 12-month period after being approved

and include the following:

•Implemented a plan to terminate 603 employees and provide

them with severance benefits in accordance with benefit plans

previously communicated to the affected employee group or with

local employment laws. The specific location of these employees

and the status of the terminations are summarized in a table

contained in this note.

•Incurred costs to exit certain leased space, including the exit

of a North American R&D facility.

•Recognized net gains associated with the disposal of several

asset groupings, the largest of which was a $3 gain related to the

disposition of a Foodservice manufacturing facility. Total proceeds

from these disposals were $9.

•Recognized costs related to the implementation of common

information systems across the organization in order to improve

operational efficiencies. These primarily relate to costs associated

with assessing current systems, the evaluation of system alterna-

tives, and process re-engineering costs, as well as the amortization

of certain capitalized software.

The following table summarizes the net charges taken for the

exit, disposal and transformation activities approved during 2008

and the related status as of June 28, 2008. The accrued amounts

remaining as of the end of 2008 represent those cash expenditures

necessary to satisfy remaining obligations. The majority of the cash

payments to satisfy the accrued costs are expected to be paid in the

next two years. The corporation does not anticipate any additional

material future charges related to the 2008 actions.

56 Sara Lee Corporation and Subsidiaries