Sara Lee 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

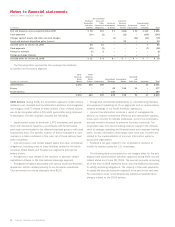

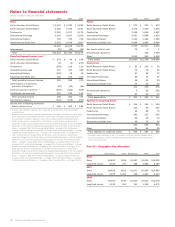

Notes to financial statements

Dollars in millions except per share data

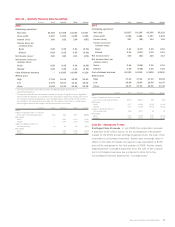

Note 17 – Guarantees

The corporation is a party to a variety of agreements under which

it may be obligated to indemnify a third party with respect to certain

matters. Typically, these obligations arise as a result of contracts

entered into by the corporation under which the corporation agrees

to indemnify a third party against losses arising from a breach of

representations and covenants related to matters such as title to

assets sold, the collectibility of receivables, specified environmental

matters, lease obligations assumed and certain tax matters. In each

of these circumstances, payment by the corporation is conditioned

on the other party making a claim pursuant to the procedures spec-

ified in the contract. These procedures allow the corporation to

challenge the other party’s claims. In addition, the corporation’s

obligations under these agreements may be limited in terms of

time and/or amount, and in some cases the corporation may have

recourse against third parties for certain payments made by the

corporation. It is not possible to predict the maximum potential

amount of future payments under certain of these agreements, due

to the conditional nature of the corporation’s obligations and the

unique facts and circumstances involved in each particular agree-

ment. Historically, payments made by the corporation under these

agreements have not had a material effect on the corporation’s

business, financial condition or results of operations. The corpora-

tion believes that if it were to incur a loss in any of these matters,

such loss would not have a material effect on the corporation’s

business, financial condition or results of operations.

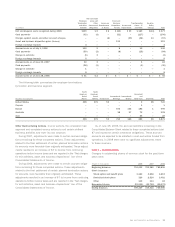

The material guarantees, within the scope of FIN 45, for which

the maximum potential amount of future payments can be deter-

mined, are as follows:

•The corporation is contingently liable for leases on property

operated by others. At June 28, 2008, the maximum potential amount

of future payments that the corporation could be required to make

if all the current operators default is $172. This contingent obliga-

tion is more completely described in Note 13 to the Consolidated

Financial Statements, “Leases”.

•The corporation has guaranteed the payment of certain third-party

debt. The maximum potential amount of future payments that the

corporation could be required to make, in the event that these third

parties default on their debt obligations, is $32. At the present time,

the corporation does not believe it is probable that any of these

third parties will default on the amount subject to guarantee.

Additionally, the corporation has pledged as collateral, a manufac-

turing facility in Brazil in connection with a tax dispute in that country.

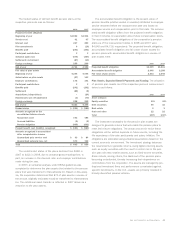

Note 18 – Financial Instruments and Risk Management

Interest Rate and Currency Swaps To manage interest rate risk,

the corporation has entered into interest rate swaps that effectively

convert certain fixed-rate debt instruments into floating-rate instru-

ments. The corporation has issued certain foreign-denominated debt

instruments and utilizes currency swaps to reduce the variability of

functional currency cash flows related to the foreign currency debt.

Interest rate swap agreements that are effective at hedging the

fair value of fixed-rate debt agreements are designated and accounted

for as fair value hedges.

Currency swap agreements that are effective at hedging the

variability of foreign-denominated cash flows are designated and

accounted for as cash flow hedges. The effective portion of the

gains or losses of currency swaps that are recorded as cash flow

hedges is recorded in accumulated other comprehensive income

and reclassified into earnings to offset the gain or loss arising from

the remeasurement of the hedged item.

The fair value of interest rate and currency swaps is determined

based upon externally developed pricing models, using financial

data obtained from swap dealers.

Weighted Average

Interest Rates 2

Notional

Principal 1Receive Pay

Interest rate swaps

2008 Receive fixed – pay variable $÷«385 5.3% 3.5%

2007 Receive fixed – pay variable 1,315 5.1 6.0

2006 Receive fixed – pay variable 1,316 5.1 5.8

Currency swaps

2008 Receive fixed – pay fixed $÷«886 5.1% 5.0%

2007 Receive fixed – pay fixed 755 5.1 5.0

2006 Receive fixed – pay fixed 711 5.1 5.0

1The notional principal is the amount used for the calculation of interest payments that

are exchanged over the life of the swap transaction and is equal to the amount of foreign

currency or dollar principal exchanged at maturity, if applicable.

2The weighted average interest rates are as of the respective balance sheet dates.

Forward Exchange, Futures and Option Contracts The corporation

uses forward exchange and option contracts to reduce the effect

of fluctuating foreign currencies on short-term foreign-currency-

denominated intercompany transactions, third-party product-sourcing

transactions, foreign-denominated investments and other known

foreign currency exposures. Gains and losses on the derivative are

intended to offset losses and gains on the hedged transaction in an

effort to reduce the earnings volatility resulting from fluctuating for-

eign currency exchange rates. The principal currencies hedged by the

corporation include the European euro, British pound, Brazilian real,

Hungarian forint, Russian ruble, Australian dollar and Danish krone.

The corporation uses commodity forwards and options to hedge

commodity price risk. The principal commodities hedged by the

corporation include hogs, beef, natural gas, diesel fuel, coffee,

corn and wheat. The corporation does not use significant levels

of commodity financial instruments to hedge commodity prices. In

circumstances where commodity-derivative instruments are used,

there is a high correlation between the commodity costs and the

derivative instrument.

66 Sara Lee Corporation and Subsidiaries