Sara Lee 2008 Annual Report Download - page 53

Download and view the complete annual report

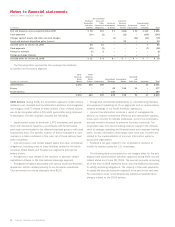

Please find page 53 of the 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Bakery – were identified as reporting units where it was reasonably

likely that they might become impaired in future periods if operating

earnings for those two reporting units did not show continued improve-

ment. The potential for impairment was disclosed in the Form 10Q

for the second and third quarters of 2008. Weaker than previously

anticipated performance and a decline in forecasted financial per-

formance occurred in the second half of 2008, which compelled

management to re-perform the goodwill impairment test for these

two business units in the fourth quarter. As a part of the review

in the fourth quarter, the corporation concluded that the carrying

amounts of the North American Foodservice Bakery and Spanish

Bakery reporting units exceeded their respective fair values. Based

upon the results of a third-party appraisal of long-lived assets and

internal estimates of discounted cash flows, management compared

the implied fair value of the goodwill in each reporting unit with the

carrying value and concluded that a $782 goodwill impairment charge

needed to be recognized. Of this amount, $382 relates to the North

American Foodservice Bakery reporting unit and $400 relates to the

Spanish Bakery reporting unit. No tax benefit is recognized on the

goodwill impairments. After the recognition of the impairment losses,

the remaining goodwill in the North American Foodservice Bakery

and Spanish Bakery reporting units is $477 and $139, respectively.

Foodservice Property, Goodwill and Trademarks

In 2008, steps were

taken to market and identify potential buyers for a business that is

part of the Foodservice segment. In June 2008, the corporation’s

board of directors authorized management to negotiate and sell the

business under certain criteria. As part of this process, the corporation

received a non-binding offer for the business which is less than

the carrying value. Utilizing the net purchase price, the corporation

conducted an impairment review of the business and recognized

a pretax impairment charge of $49 in the fourth quarter of 2008,

of which $36, $8 and $5 are related to property, goodwill and trade-

marks, respectively. The after tax impact of the impairment charge

is $33. The remaining assets of this reporting unit were classified

as held for sale at the end of 2008.

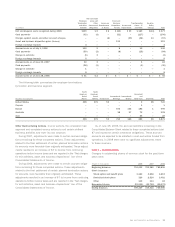

2007 Impairment Charges Recognized in Continuing Operations

North American Retail Meats Property

During the second quarter

of 2007, management completed an analysis of the manufacturing

activities being conducted at a facility that is part of the North

American Retail Meats segment. As a result of this analysis, the

corporation concluded that operations at this facility would be

substantially reduced in order to improve efficiency and long-term

profitability. Certain of the activities performed at the location have

been transferred to more efficient third-party suppliers and others

have been eliminated as part of the shutdown of this plant. These

actions are consistent with the corporation’s previously announced

transformation plan. Based upon the results of a third-party appraisal

and internal estimates of cash flows to be generated through the date

of disposition, the corporation concluded that it was necessary to

recognize an impairment charge of $34 for this asset group in 2007.

The after tax impact of this impairment charge is $22.

North American Retail Bakery Trademarks

In 2007, as part of the

corporation’s transformation plan to improve operating efficiency and

profitability, the North American Retail Bakery business continues

to focus its marketing, advertising and promotion spending on a

select number of brands. As a result of these plans, the company

assessed the recoverability of certain trademarks impacted by this

strategy. The company determined that the undiscounted cash flows

over the remaining lives of the trademarks did not recover the carrying

value of the assets. Therefore, the company calculated the estimated

fair value of the trademarks using the royalty savings method and

recorded an impairment charge of $16 for the difference between

fair value and carrying value. The after tax impact of the trademark

impairment charge is $10.

International Beverage Goodwill and Trademarks

In 2007, the

corporation recognized a $118 pretax impairment charge in its

International Beverage operations to record the impairment of $92

of goodwill and $26 of trademarks. No tax benefit was recognized

on the goodwill impairment charge. The after tax impact of the

trademark impairment charge is $17.

Goodwill Impairment – In 2007, the corporation concluded that the

carrying amounts of its Brazilian and Austrian coffee reporting units

exceeded their respective fair values. As a result, the corporation

compared the implied fair value of the goodwill in each reporting

unit with the carrying value and concluded that a $92 impairment

loss needed to be recognized. Of this amount, $86 relates to the

Brazilian reporting unit and $6 relates to the Austrian reporting

unit. The impairment loss recognized equals the entire remaining

amount of goodwill in each reporting unit.

The Brazilian coffee operation had experienced a sustained

decline in profitability due to a highly competitive market in which the

business operates. As a result of the sustained underperformance

of this business, management revised its future cash flow expecta-

tions in the second quarter of 2007. These revised future cash flow

expectations, along with comparable fair value information from the

recent sale of a coffee business of comparable size and profitability,

resulted in the corporation lowering its estimate of fair value of

the business in the 2007 impairment review. Similarly, the under-

performance of the Austrian business in 2007 led the corporation

to lower its forecasted future cash flow expectations and resultant

estimate of fair value.

Trademark Impairment – In conjunction with the actions resulting

in the impairment of the Brazilian goodwill, the corporation assessed

the realization of its long-lived assets associated with this held-for-

use asset grouping. The primary asset in this asset group was

determined to be trademarks, which had a carrying value of $47

and are being amortized over 10 years. Using the anticipated undis-

counted cash flows of the asset group, the corporation concluded

that the asset group was not fully recoverable. As a result of this

evaluation, the corporation concluded that the carrying value of the

trademarks exceeded the fair value by $26. The fair value of the

trademarks was estimated using the royalty savings method.

After considering the lower future profit expectations for the

Brazilian operations, the corporation concluded that it was also nec-

essary to recognize a $27 valuation reserve on the net deferred tax

assets related to the Brazilian tax jurisdiction as the realization of

such tax assets was not reasonably assured. This charge is reported

as tax expense in the 2007 Consolidated Statement of Income.

Sara Lee Corporation and Subsidiaries 51