Sara Lee 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Reaching higher

2008 Annual Report

Table of contents

-

Page 1

2008 Annual Report Reaching higher -

Page 2

Financial highlights Dollars in millions except per share data Years ended June 28, 2008 1 June 30, 2007 1 % Change Results of Operations Continuing operations Net sales Income before income taxes Income (loss) Income (loss) per share of common stock - diluted Income (loss) from discontinued ... -

Page 3

... also built stronger brands with better market positions. And, we continued to improve essential capabilities such as innovation, supply chain management and pricing. We've made a lot of progress since we started our journey, but we are reaching even higher for the future. Fiscal 2008 In a year of... -

Page 4

Performance at a glance Top ten brands and sales growth + 17 % $1.1 B I L L I O N SARA LEE BRAND EXCEEDS SOME OF THE MANY NEW PRODUCTS SARA LEE S U C C E S S F U L LY LAUNCHED IN FISCAL 2008 +7 % $738 M I L L I O N + 16 % $608 M I L L I O N $ + 23 % $547 M I L L I O N 1B IN SALES FOR THE ... -

Page 5

...sales breakdown Net sales by business segment 17% 7% 17% 24% 17% â- Nor th American Retail Meats â- Nor th American Retail Baker y â- Foodservice â- International Beverage â- International Baker y â- Household and Body Care 18% Net sales by geography 3% 6% 1% 35% 52% 3% North America... -

Page 6

...our namesake Sara Lee brand, which is the #1 fresh bakery and frozen sweet goods brand in the United States. We are also building on our strong position in the U.S. packaged meats category through innovative products, great category management and effective, eyecatching advertising for our Ball Park... -

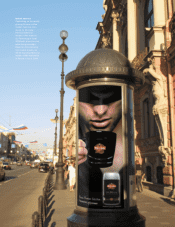

Page 7

...success Capitalizing on the rapidly growing Russian coffee market, Sara Lee introduced its Moccona Premium Selection instant coffee brand in St. Petersburg in fiscal 2008 with a hard-to-miss advertising campaign. Based on the promising test market results, we will be launching Moccona instant coffee... -

Page 8

...Sara Lee Sara Lee is nearing completion of its new, 82,000 square-foot research and development campus located near the site of the company's corporate... labs. Two new pilot plants for meat and bakery will also provide us with the ability to test-run small-scale production of our new products. -

Page 9

...the United States. This exciting new agreement gives Sara Lee the right to sell and market Dunkin' Donuts coffee throughout the foodservice channel, to locations such as office buildings and cafeterias, helping America run on Dunkin'. Investing in our brands Building strong, relevant brands through... -

Page 10

... and our North American businesses together into one office building in the western suburbs of Chicago. The aim: to fully leverage our employee talent, promote high levels of collaboration among people and departments and, ultimately, foster a new company culture. Diversity At Sara Lee, we are... -

Page 11

...' equity Consolidated statements of cash flows Notes to financial statements Report of independent registered public accounting firm Management's report Reconciliation of non-GAAP measures Performance graph Directors and senior corporate officers Investor information Sara Lee Corporation 9 -

Page 12

Financial summary Dollars in millions except per share data Years ended June 28, 2008 1 June 30, 2007 2 July 1, 2006 3 July 2, 2005 4 July 3, 2004 5,6 Results of Operations Continuing operations Net sales Operating income7 Income before income taxes Income (loss) Effective tax rate Income (loss) ... -

Page 13

..., beverage, and household products categories. Our major brands include Ambi Pur, Ball Park, Douwe Egberts, Hillshire Farm, Jimmy Dean, Kiwi, Sanex, Senseo and our namesake, Sara Lee. In North America, the North American Retail Meats segment sells a variety of packaged meat products that include hot... -

Page 14

... certain other assets in the North American operations. • Operating segment income increased at each of the business segments, with the exception of Foodservice and International Bakery, driven by favorable changes in foreign currency exchange rates, pricing actions, improved volumes and sales mix... -

Page 15

... tax valuation allowance adjustment Tax benefit on disposition of a business Contingent tax obligation adjustment Tax on repatriation of prior years' earnings Other tax adjustments, net Impact on income from continuing operations Significant items impacting discontinued operations U.K. Pension plan... -

Page 16

... Percent Change In millions 2008 2007 Net sales Increase/(decrease) in net sales from Changes in currency rates Acquisitions/dispositions Total Operating income Increase/(decrease) in operating income from Contingent sale proceeds Changes in currency rates Exit activities, asset and business... -

Page 17

... to 32.6% in 2007. SG&A expenses as a percent of sales declined in each of the business segments with the exception of North American Retail Meats and International Beverage. Total SG&A expenses reported in 2008 by the business segments increased by $229 million, or 6.6%, over 2007 primarily due to... -

Page 18

... other asset dispositions, which was partially offset by a $39 million charge to prepare businesses for disposition. Continuing operations Income before income taxes Income tax expense (benefit) Effective tax rates $÷«160 201 125.6% $429 (11) (2.6) % $«189 158 83.6% 16 Sara Lee Corporation and... -

Page 19

... of earnings from certain foreign subsidiaries. • Sale of Capital Assets - The corporation sold the shares of a subsidiary in the first quarter of 2007, which resulted in a $169 million tax benefit. • Finalization of Tax Reviews and Audits - During 2007, the corporation recorded net adjustments... -

Page 20

... meat products to retail customers in North America. Products include hot dogs and corn dogs, breakfast sausages and sandwiches, smoked and dinner sausages, premium deli and luncheon meats, bacon and cooked hams. The major brands include Hillshire Farm, Ball Park, Jimmy Dean, Sara Lee, Bryan, State... -

Page 21

... prior year. Net Sales Bridge - Components of Change 2008 versus 2007 Price/Mix/ Acquisitions/ Other Dispositions Volume Currency Total North American Retail Meats North American Retail Bakery Foodservice International Beverage International Bakery Household and Body Care Total business segments... -

Page 22

Financial review Net Sales Bridge - Components of Change 2007 versus 2006 Price/Mix/ Acquisitions/ Other Dispositions Volume Currency Total North American Retail Meats North American Retail Bakery Foodservice International Beverage International Bakery Household and Body Care Total business ... -

Page 23

... as whole hogs are now being sold to another meat processor, resulting in an increase in non-retail commodity unit volumes for the year, but lower overall non-retail commodity meat revenues due to the low sales price per unit for hogs. Operating segment income increased by $81 million, or 87.2%, in... -

Page 24

...bakery products as well as nonbranded fresh bakery products. Sales of Sara Lee branded products continued their strong growth, with an increase of 19% versus the prior year. Operating segment income increased by $57 million in 2008. The net impact of the change in exit activities, asset and business... -

Page 25

... bakery and beverage businesses. The remaining operating segment income decline of $9 million, or 7.5%, was due to higher commodity and overhead costs as well as lower unit volumes, partially offset by pricing actions, and savings from continuous improvement initiatives. 2007 versus 2006 Net sales... -

Page 26

....5%. The remaining operating segment income increase of $32 million, or 7.4%, was due to higher unit volumes, an improved product mix and lower pension costs, partially offset by higher selling and administrative costs and higher media advertising and promotion expense. 24 Sara Lee Corporation and... -

Page 27

... was a result of higher unit volumes and price increases to offset certain cost increases. Net unit volumes increased 1.9% in 2007 with increases in unit volumes for refrigerated dough products and fresh bread in Europe and frozen baked goods in Australia. Operating segment income increased by $18... -

Page 28

Financial review Household and Body Care Dollar Change Percent Change Dollar Change Percent Change In millions 2008 2007 2007 2006 Net sales Increase/(decrease) in net sales from Changes in foreign currency exchange rates Acquisition/dispositions Total Operating segment income Increase/(... -

Page 29

... the previous sale of the corporation's tobacco product line. The increase versus the prior year was due to a change in foreign currency exchange rates. During 2007, the corporation completed the disposition of Hanesbrands and the European Meats businesses. The net assets of businesses disposed of... -

Page 30

...businesses that are reported in discontinued operations, the sale of certain working capital, trademarks and assets related to certain suncare and rice product lines, proceeds from the sale of an investment in a foreign company and $114 million in contingent proceeds from the sale of the corporation... -

Page 31

... made to pension plans in any year is dependent upon a number of factors, including minimum funding requirements in the jurisdictions in which the company operates, the timing of cash tax benefits for amounts funded and arrangements made with the trustees of certain foreign plans. As a result, the... -

Page 32

... continue to purchase these live hogs and therefore, the corporation has entered into a hog sales contract under which these hogs will be sold to another slaughter operator. The corporation's purchase price of these hogs is generally based on the price of corn products, and the corporation's selling... -

Page 33

...." The following table aggregates information on the corporation's contractual obligations and commitments: Payments Due by Fiscal Year In millions Total 2009 2010 2011 2012 2013 Thereafter Long-term debt Interest on debt obligations1 Operating lease obligations Purchase obligations2 Other... -

Page 34

... currency exchange rates for a one-day period. The average value at risk amount represents the simple average of the quarterly amounts for the past year. These amounts are not significant compared with the equity, historical earnings trend or daily change in market capitalization of the corporation... -

Page 35

... on the balance sheet at the lower of cost or market. Obsolete, damaged and excess inventories are carried at net realizable value. Historical recovery rates, current market conditions, future marketing and sales plans and spoilage rates are key factors used by the corporation in assessing the... -

Page 36

... by segment management. In evaluating the recoverability of goodwill, it is necessary to estimate the fair value of the reporting units. In making this assessment, management relies on a number of factors to discount anticipated future cash flows including operating results, business plans and... -

Page 37

... impact on income tax expense, net income and liquidity in future periods: • The spin off of the Hanesbrands business that was completed in 2007 has resulted in, and may continue to result in, an increase in the corporation's effective tax rate in future years as the operations that were spun... -

Page 38

... impact on future operating results. Defined Benefit Pension Plans See Note 19 to the Consolidated Financial Statements, titled "Defined Benefit Pension Plans," for information regarding plan obligations, plan assets and the measurements of these amounts, as well as the net periodic benefit cost and... -

Page 39

The corporation's defined benefit pension plans had a net actuarial loss of $570 million in 2008 and $746 million at the end of 2007. At June 28, 2008, the unamortized actuarial loss is reported in the "Accumulated other comprehensive loss" line of the Consolidated Balance Sheet. The reduction in ... -

Page 40

... on sales and profitability of Sara Lee products; and (vi) inherent risks in the marketplace associated with new product introductions, including uncertainties about trade and consumer acceptance; • Sara Lee's international operations, such as (vii) impacts on reported earnings from fluctuations... -

Page 41

...) on sale of discontinued operations, net of tax expense (benefit) of $1, $(11), and $65 Net income (loss) Income (loss) from continuing operations per share of common stock Basic Diluted Net income (loss) per share of common stock Basic Diluted The accompanying Notes to Financial Statements are an... -

Page 42

... receivable, less allowances of $91 in 2008 and $82 in 2007 Inventories Finished goods Work in process Materials and supplies Current deferred income taxes Other current assets Assets of discontinued operations Total current assets Other non-current assets Property Land Buildings and improvements... -

Page 43

... held for sale Total current liabilities Long-term debt Pension obligation Deferred income taxes Other liabilities Liabilities of discontinued operations Minority interests in subsidiaries Common stockholders' equity Common stock: (authorized 1,200,000,000 shares; $0.01 par value) Issued and... -

Page 44

... Statements of Common Stockholders' Equity Common Stock Capital Surplus Retained Earnings Unearned Stock Accumulated Other Comprehensive Income (Loss) Comprehensive Income Dollars in millions Total Balances at July 2, 2005 Net income Translation adjustments, net of tax of $(43) Minimum pension... -

Page 45

... dispositions Increase (decrease) in deferred income taxes Other Change in current assets and liabilities, net of businesses acquired and sold Trade accounts receivable Inventories Other current assets Accounts payable Accrued liabilities Accrued taxes Net cash from operating activities Investment... -

Page 46

...Food and beverage sales are made in both the retail channel, to supermarkets, warehouse clubs and national chains, and the foodservice channel. Household and body care products are primarily sold through the retail channel. Basis of Presentation The Consolidated Financial Statements include Sara Lee... -

Page 47

... the total error in the balance sheet as of the end of the current period. The corporation adopted SAB 108 in the fourth quarter of 2007 and recognized a $58 adjustment upon adoption. Note 2 - Summary of Significant Accounting Policies The Consolidated Financial Statements include the accounts of... -

Page 48

... is recognized in the "Selling, general and administrative expenses" line in the Consolidated Statements of Income. Total media advertising expense for continuing operations was $325 in 2008, $313 in 2007 and $298 in 2006. Cash and Equivalents All highly liquid investments purchased with a maturity... -

Page 49

... assigned to the reporting unit or units of the corporation given responsibility for managing, controlling and generating returns on these assets and liabilities. Reporting units are business components one level below the operating segment level for which discrete financial information is available... -

Page 50

... 3, 2005, the corporation adopted the provisions of Statement of Financial Accounting Standards No. 123(R), "Share-Based Payment" (SFAS No. 123(R)), using the modified prospective method. SFAS No. 123(R) requires companies to recognize the cost of employee services received in exchange for awards of... -

Page 51

... a change in the plan measurement date to fiscal year end. Financial Instruments The corporation uses financial instruments, including forward exchange, options, futures and swap contracts, to manage its exposures to movements in interest rates, foreign exchange rates and commodity prices. The... -

Page 52

... the fair value of these intangible assets. In the second quarter of fiscal 2008, this review was performed and, although the test did not indicate any reporting units may be impaired, two reporting units - North American Foodservice Bakery and Spanish 50 Sara Lee Corporation and Subsidiaries -

Page 53

... asset group in 2007. The after tax impact of this impairment charge is $22. North American Retail Bakery Trademarks In 2007, as part of the corporation's transformation plan to improve operating efficiency and profitability, the North American Retail Bakery business continues Sara Lee Corporation... -

Page 54

... 5 to 20 years. 2006 Impairment Charges Recognized in Continuing Operations North American Retail and International Bakery Trademarks As part of the transformation plan, the operating management of the bakery business was changed at the start of 2006 and new long-range plans were developed for the... -

Page 55

... core brands in the U.S. The corporation recognized a pretax loss of $23 and an after tax loss of $24. A total of $55 million of cash proceeds was received from the disposition of the business. The Mexican meats operation had been reported in the North American Retail Meats segment. Businesses Sold... -

Page 56

... working capital adjustments related to the assets transferred, finalized certain related tax reporting and completed certain financial and tax reporting adjustments related to the U.K. Apparel and Direct Selling businesses that were sold in 2006. As a result of these adjustments, the corporation... -

Page 57

... performance and better position the company for long-term growth. The plan involved significant changes in the company's organizational structure, portfolio changes involving the disposition of a significant portion of the corporation's business, and a number of actions to improve operational... -

Page 58

...on diluted EPS from continuing operations: In millions 2008 2007 2006 North American Retail Meats North American Retail Bakery Foodservice International Beverage International Bakery Household and Body Care Decrease in business segment income Increase in general corporate expenses Total $13 4 5 15... -

Page 59

... by location and business segment. North American Retail Meats North American Retail Bakery Number of employees International International Foodservice Beverage Bakery Household and Body Care Corporate Total United States Europe Australia As of June 28, 2008 Actions completed Actions remaining... -

Page 60

... table summarizes the employee terminations by location and business segment. North American Retail Meats North American Retail Bakery Number of employees International International Foodservice Beverage Bakery Household and Body Care Corporate Total United States Europe South America 1,572... -

Page 61

... summarizes the employee terminations by location and business segment. North American Retail Meats North American Retail Bakery Number of employees International International Foodservice Beverage Bakery Household and Body Care Corporate Total United States Canada Europe Australia Asia 328... -

Page 62

... to other employee groups. A summary of the changes in stock options outstanding under the corporation's option plans during 2008 is presented below: Weighted Weighted Average Average Remaining Exercise Contractual Price Term (Years) Shares in thousands Shares Aggregate Intrinsic Value Options... -

Page 63

... expense related to stock unit plans that will be recognized over the weighted average period of 1.81 years. Expense Recognized for All Stock-Based Compensation For all share-based payments during 2008, the corporation recognized total compensation expense of $38 and recognized a tax benefit of $10... -

Page 64

... the current operators default on the rental arrangements, is $172. The minimum annual rentals under these leases are $29 in 2009, $27 in 2010, $23 in 2011, $18 in 2012, $14 in 2013 and $61 thereafter. The two largest components of these amounts relate to a number of retail store leases operated by... -

Page 65

... has been reallocated based upon the relative fair value of the reporting units that existed at the time the corporation realigned its business units into new segments during 2006. During 2006 and through the first quarter of 2008, the goodwill allocated to the International Bakery segment had been... -

Page 66

...: North American Retail Bakery North American Retail Meats International International Foodservice Beverage Bakery Household and Body Care Total Net book value at July 1, 2006 Impairment Foreign exchange/other Net book value at June 30, 2007 Impairments Reclass to net assets held for sale... -

Page 67

... of its own employee-participants. Based upon the PBGC determination and the advice of counsel, the corporation has recognized its obligations under the plan as if it participated in a single-employer defined benefit plan under the provisions of Statement of Financial Accounting Standards No. 87... -

Page 68

... June 28, 2008, the maximum potential amount of future payments that the corporation could be required to make if all the current operators default is $172. This contingent obligation is more completely described in Note 13 to the Consolidated Financial Statements, "Leases". • The corporation has... -

Page 69

...accounts payable approximated fair value as of June 28, 2008 and June 30, 2007. The fair value of the remaining financial instruments recognized in continuing operations on the Consolidated Balance Sheets of the corporation at the respective year-ends were: 2008 2007 Foreign currency - bought (sold... -

Page 70

... fixed-income investments that have a AA bond rating and match the average duration of the pension benefit payments. Salary increase assumptions are based upon historical experience and anticipated future management actions. In determining the long-term rate of return on plan assets, the corporation... -

Page 71

... value of plan assets Beginning of year Actual return on plan assets Employer contributions Participant contributions Benefits paid Settlement Acquisitions/(dispositions) Hanesbrands spin off adjustment Foreign exchange End of year Funded status Amounts recognized on the consolidated balance sheets... -

Page 72

... payments are made from assets of the pension plans. Using foreign currency exchange rates as of June 28, 2008 and expected future service, it is anticipated that the future benefit payments will be as follows: $245 in 2009, $242 in 2010, $252 in 2011, $264 in 2012, $272 in 2013 and $1,486 from 2014... -

Page 73

... obligation Beginning of year Service cost Interest cost Net benefits paid Actuarial (gain) loss Curtailment Foreign exchange End of year Fair value of plan assets Funded status Amounts recognized on the consolidated balance sheets Accrued liabilities Other liabilities Total liability recognized... -

Page 74

...for income taxes from continuing operations were $459 in 2008, $378 in 2007 and $121 in 2006. The deferred tax liabilities (assets) at the respective year-ends were as follows: 2008 2007 Deferred tax (assets) Pension liability Employee benefits Unrealized foreign exchange Nondeductible reserves Net... -

Page 75

... Segment Information The following are the corporation's six business segments and the types of products and services from which each reportable segment derives its revenues. • North American Retail Meats sells a variety of meat products to retail customers in North America, including hot dogs... -

Page 76

Notes to financial statements Dollars in millions except per share data 2008 2007 2006 2008 2007 2006 Sales1,2 North American Retail Meats North American Retail Bakery Foodservice International Beverage International Bakery Household and Body Care Intersegment Total Operating Segment Income (Loss... -

Page 77

...Quarter First Second Third Fourth Quarter First Second Third Fourth 2008 Continuing operations1 Net sales Gross profit Income (loss) Income (loss) per common share Basic Diluted Net income (loss)2 Net income (loss) per common share Basic2 Diluted2 Cash dividends declared Market price High Low Close... -

Page 78

...Public Accounting Firm To the Board of Directors and Stockholders of Sara Lee Corporation In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of income, common stockholders' equity and cash flows present fairly, in all material respects, the financial... -

Page 79

...design and operating effectiveness of its internal control over financial reporting. Management of the corporation reviewed the results of its assessment with the Audit Committee of our Board of Directors. Based on the corporation's assessment, management has concluded that, as of June 28, 2008, the... -

Page 80

... tax benefit recognized from the sale of shares of a subsidiary. June 28, 2008 June 30, 2007 Year ended Diluted EPS from continuing operations, as reported Less Net impact of significant items on income from continuing operations $(0.06) $«0.59 In millions 2008 2007 Total Sara Lee Net sales... -

Page 81

... Company. The returns on the Peer Composite index were calculated as follows: At the beginning of each fiscal year the amount invested in each S&P industry sector index was equivalent to the percentage of Sara Lee's operating profits in its food and beverage businesses and its household products... -

Page 82

... corporate secretary Christopher J. (CJ) Fraleigh, 44 Executive vice president, chief operating officer, North America Vincent H.A.M. Janssen, 55 Executive vice president, chief executive officer, International Household and Body Care L.M. (Theo) de Kool, 55 Executive vice president, chief financial... -

Page 83

... invest additional cash amounts in Sara Lee Corporation common stock. A complete Plan prospectus as well as other shareholder services forms can be found on our Web site at www.saralee.com in the Investor Relations section (Shareholder Services/Account Access) or you can request further information... -

Page 84

Sara Lee Corporation 3500 Lacey Road Downers Grove, IL 60515-5424 + 1.800.SARA.LEE + 1.630.598.6000 www.saralee.com