Pitney Bowes 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

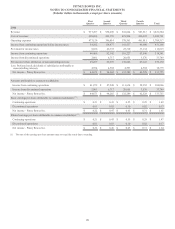

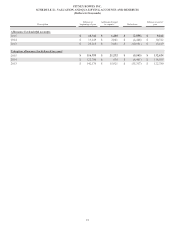

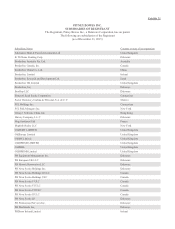

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

83

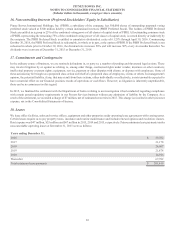

16. Noncontrolling Interests (Preferred Stockholders’ Equity in Subsidiaries)

Pitney Bowes International Holdings, Inc. (PBIH), a subsidiary of the company, has 300,000 shares of outstanding perpetual voting

preferred stock valued at $300 million held by certain institutional investors (PBIH Preferred Stock). The holders of PBIH Preferred

Stock are entitled as a group to 25% of the combined voting power of all classes of capital stock of PBIH. All outstanding common stock

of PBIH, representing the remaining 75% of the combined voting power of all classes of capital stock, is owned directly or indirectly by

the company. The PBIH Preferred Stock is entitled to cumulative dividends at a rate of 6.125% through April 30, 2016. Commencing

October 30, 2016, the PBIH Preferred Stock is redeemable, in whole or in part, at the option of PBIH. If the PBIH Preferred Stock is not

redeemed in whole prior to October 30, 2016, the dividend rate increases 50% and will increase 50% every six months thereafter. No

dividends were in arrears at December 31, 2015 or December 31, 2014.

17. Commitments and Contingencies

In the ordinary course of business, we are routinely defendants in, or party to, a number of pending and threatened legal actions. These

may involve litigation by or against us relating to, among other things, contractual rights under vendor, insurance or other contracts;

intellectual property or patent rights; equipment, service, payment or other disputes with clients; or disputes with employees. Some of

these actions may be brought as a purported class action on behalf of a purported class of employees, clients or others. In management's

opinion, the potential liability, if any, that may result from these actions, either individually or collectively, is not reasonably expected to

have a material effect on our financial position, results of operations or cash flows. However, as litigation is inherently unpredictable,

there can be no assurances in this regard.

In 2015, we finalized the settlement with the Department of Justice relating to an investigation it had conducted regarding compliance

with certain postal regulatory requirements in our Presort Services business without any admission of liability by the Company. As a

result of the settlement, we recorded a charge of $7 million, net of estimated recoveries in 2015. This charge is recorded in other (income)

expense, net in the Consolidated Statements of Income.

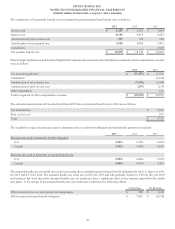

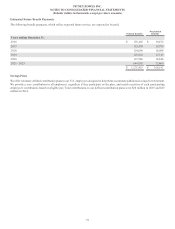

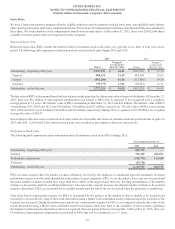

18. Leases

We lease office facilities, sales and service offices, equipment and other properties under operating lease agreements with varying terms.

Certain leases require us to pay property taxes, insurance and routine maintenance and include renewal options and escalation clauses.

Rent expense was $47 million, $55 million and $67 million in 2015, 2014 and 2013, respectively. Future minimum lease payments under

non-cancelable operating leases at December 31, 2015 were as follows:

Years ending December 31,

2016 $ 39,782

2017 31,178

2018 26,087

2019 21,874

2020 14,916

Thereafter 67,782

Total minimum lease payments $ 201,619