Pitney Bowes 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

71

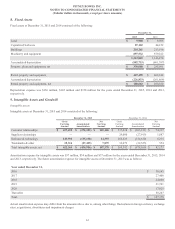

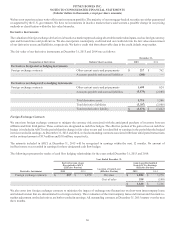

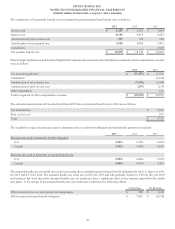

Pretax amounts recognized in AOCI consist of:

United States Foreign

2015 2014 2015 2014

Net actuarial loss $ 880,123 $ 918,641 $ 255,994 $ 253,257

Prior service credit (512)(144)(740)(806)

Transition asset ——(40)(49)

Total $ 879,611 $ 918,497 $ 255,214 $ 252,402

The estimated amounts that will be amortized from AOCI into net periodic benefit cost in 2016 are as follows:

United States Foreign

Net actuarial loss $ 26,824 $ 5,804

Prior service credit (60) (66)

Transition asset —(9)

Total $ 26,764 $ 5,729

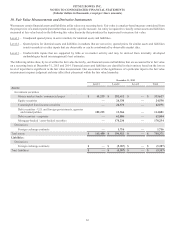

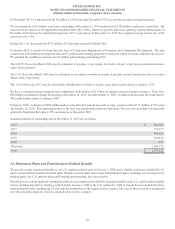

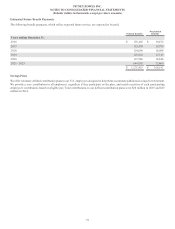

The components of net periodic benefit cost (income) for defined benefit pension plans were as follows:

United States Foreign

2015 2014 2013 2015 2014 2013

Service cost $ 134 $ 6,908 $ 13,981 $ 2,229 $ 3,565 $ 6,272

Interest cost 74,331 77,655 74,370 24,261 28,518 27,365

Expected return on plan assets (104,004) (103,822)(107,608)(35,421)(39,137) (34,769)

Amortization of net transition asset ——— (9)(10)(9)

Amortization of prior service (credit) cost (60) 9 380 (66)(57) 112

Amortization of net actuarial loss 29,272 25,369 32,494 5,926 8,268 14,445

Special termination benefits —— 548 79 1,238 935

Settlement / curtailment 1,243 4,528 2,638 ———

Net periodic benefit cost (income) $ 916 $ 10,647 $ 16,803 $(3,001)$ 2,385 $ 14,351

Other changes in plan assets and benefit obligations for defined benefit pension plans recognized in other comprehensive income were

as follows:

United States Foreign

2015 2014 2015 2014

Net actuarial (gain) loss $(8,003)$ 214,593 $ 8,663 $ 61,525

Prior service credit (428)———

Amortization of net actuarial loss (29,272)(25,369)(5,926)(8,268)

Amortization of prior service credit (cost) 60 (9)66 57

Net transition asset ——910

Settlement / curtailment (1,243)(4,528)——

Total recognized in other comprehensive income $(38,886)$ 184,687 $ 2,812 $ 53,324