Pitney Bowes 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

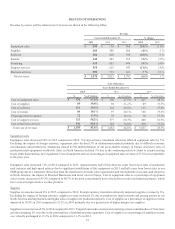

Net income from continuing operations and earnings per diluted share for the year were $403 million and $2.00, respectively, compared

to $300 million and $1.47, respectively, in 2014. The increase was primarily due to improving gross margins and lower selling, general

and administrative expenses due in part to the benefits of our restructuring actions, changes in our go-to-market strategy and other

productivity initiatives. A 5% increase in the effective tax rate partially offset these benefits.

We generated cash flow from operations of $515 million, received proceeds of $292 million from the sale of Imagitas and $52 million

from the sale of our former corporate headquarters building and other assets, and issued $90 million of commercial paper. We used cash

of $394 million to acquire businesses, $365 million to reduce debt, $166 million to fund capital investments, $168 million to pay dividends

to our stockholders and noncontrolling interests and $132 million to repurchase our common stock. At December 31, 2015, cash and cash

equivalents was $651 million.

Outlook

Our growth initiatives continue to focus on leveraging our expertise in physical and digital communications, hybrid communications and

the development of products, software, services and solutions that help our clients connect with customers to power commerce and grow

their businesses.

In 2016, we will continue to invest in the implementation of our ERP system in the United States and launch a new advertising campaign.

We anticipate the continued benefits from our restructuring actions, synergies from acquisitions, the benefits of the go-to-market strategy

in major markets and expected benefits from the implementation of the new ERP system should mostly offset these incremental costs.

In February 2016, we received additional authorization to repurchase an additional $150 million of our common stock and expect to

repurchase up to $215 million of our common stock during 2016.

During 2015, we experienced a considerable strengthening of the U.S. dollar. A continuing strong U.S. dollar could adversely affect our

reported revenues and profitability, both from a translation perspective and as a competitive perspective, as the cost of international

competitors’ products and solutions improves relative to products and solutions sold from the U.S. A strengthening dollar could also

continue to affect demand for U.S. goods sold to consumers in other countries through our global ecommerce operations.

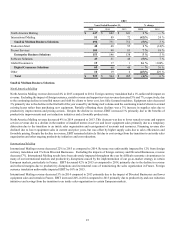

Within SMB Solutions, the introduction of new solutions and services is being well-received in the marketplace and we anticipate further

stabilization in revenue through further product upgrades and launches in 2016. Internationally, the implementation of our go-to-market

strategy is now complete in our major markets and as a result we expect stabilizing trends in those markets. We will also focus on the

transition and training of a new sales organization, which is expected to improve productivity.

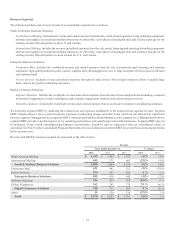

Within Enterprise Business Solutions, we expect continued revenue and profitability growth in Presort Services due to client expansion

and higher processed mail volumes; however, we anticipate that Production Mail revenue growth will continue to be challenged by the

uncertain macroeconomic environment in Europe and declining services revenue.

Within DCS, we anticipate increased demand in Software Solutions due to new industry-specific solutions, expansion of our partner

channel and improved sales efficiencies, and revenue growth in Global Ecommerce from our retail business and continued demand for

our shipping solutions driven by new client acquisitions and expanded services provided to existing clients should further enhance our

performance. In January 2016, we acquired a cloud-based, software-as-a-service enterprise retail and fulfillment solutions company.