Pitney Bowes 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

55

Goodwill represents the excess of the purchase price over the fair values of assets acquired and liabilities assumed. Goodwill is primarily

attributable to expected growth opportunities, synergies and other benefits that we believe will result from combining the operations of

Borderfree with our operations. Goodwill is not deductible for tax purposes.

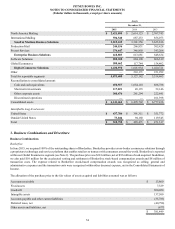

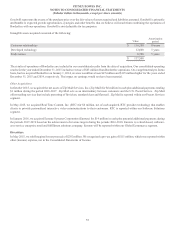

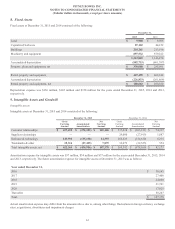

Intangible assets acquired consisted of the following:

Value

Amortization

period

Customer relationships $ 116,200 10 years

Developed technology 12,600 5 years

Trade names 8,700 5 years

$ 137,500

The results of operations of Borderfree are included in our consolidated results from the date of acquisition. Our consolidated operating

results for the year ended December 31, 2015 includes revenue of $63 million from Borderfree operations. On a supplemental pro forma

basis, had we acquired Borderfree on January 1, 2014, revenue would have been $47 million and $125 million higher for the years ended

December 31, 2015 and 2014, respectively. The impact on earnings would not have been material.

Other Acquisitions

In October 2015, we acquired the net assets of Zip Mail Services, Inc. (Zip Mail) for $6 million in cash plus additional payments totaling

$1 million during the period 2016-2017. Zip Mail acts as an intermediary between customers and the U.S. Postal Service. Zip Mail

offers mailing services that include presorting of first class, standard class and flat mail. Zip Mail is reported within our Presort Services

segment.

In May 2015, we acquired Real Time Content, Inc. (RTC) for $6 million, net of cash acquired. RTC provides technology that enables

clients to provide personalized interactive video communications to their customers. RTC is reported within our Software Solutions

segment.

In January 2016, we acquired Enroute Systems Corporation (Enroute) for $14 million in cash plus potential additional payments during

the periods 2017-2019 based on the achievement of revenue targets during the periods 2016-2018. Enroute is a cloud-based, software-

as-a-service enterprise retail and fulfillment solutions company. Enroute will be reported within our Global Ecommerce segment.

Divestiture

In May 2015, we sold Imagitas for net proceeds of $292 million. We recognized a pre-tax gain of $111 million, which was reported within

other (income) expense, net in the Consolidated Statements of Income.