Pitney Bowes 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

77

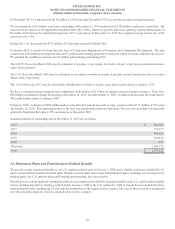

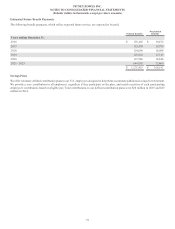

Foreign Pension Plans

Diversified

growth funds Real estate Total

Balance at December 31, 2014 $ — $ — $ —

Unrealized gains (119)(1,685) (1,804)

Net purchases, sales and settlements 20,632 40,862 61,494

Balance at December 31, 2015 20,513 39,177 59,690

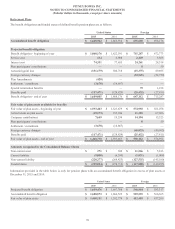

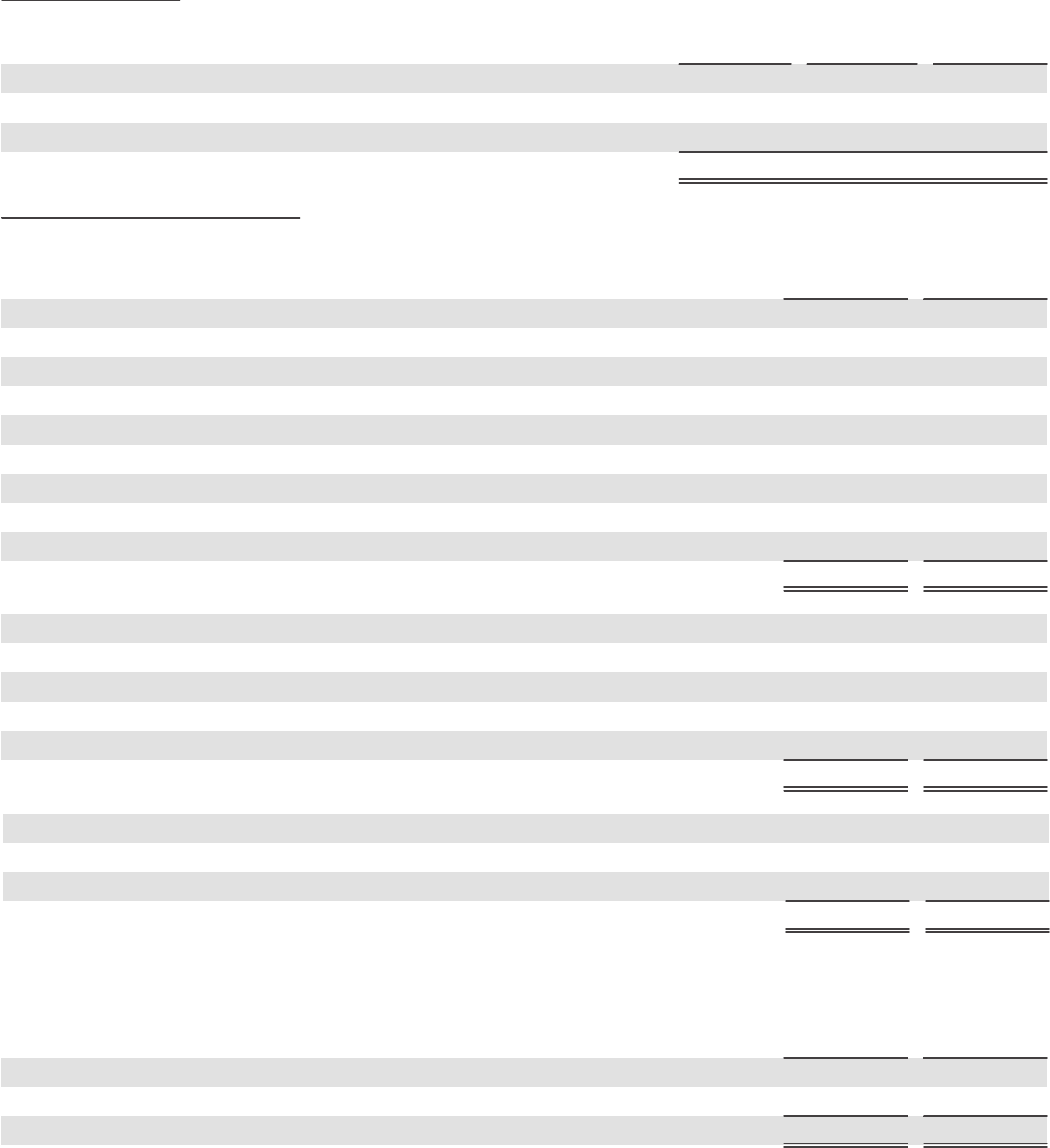

Nonpension Postretirement Benefits

The benefit obligation and funded status for nonpension postretirement benefit plans are as follows:

2015 2014

Benefit obligation

Benefit obligation - beginning of year $ 253,980 $ 231,153

Service cost 2,455 2,683

Interest cost 8,799 9,951

Plan participants' contributions 4,332 5,418

Actuarial (gain) loss (31,253)37,532

Foreign currency changes (3,289)(2,096)

Curtailment —(2,160)

Benefits paid (23,146)(28,501)

Benefit obligation - end of year (1) $ 211,878 $ 253,980

Fair value of plan assets

Fair value of plan assets - beginning of year $—

$—

Company contribution 18,814 23,083

Plan participants' contributions 4,332 5,418

Benefits paid (23,146)(28,501)

Fair value of plan assets - end of year $—

$—

Amounts recognized in the Consolidated Balance Sheets

Current liability $(19,406)$ (22,113)

Non-current liability (192,472)(231,867)

Funded status $(211,878)$ (253,980)

(1) The benefit obligation for the U.S. nonpension postretirement plans was $198 million and $231 million at December 31, 2015 and 2014, respectively.

Pretax amounts recognized in AOCI consist of:

2015 2014

Net actuarial loss $ 59,174 $ 97,955

Prior service cost 2,060 2,356

Total $ 61,234 $ 100,311