Pitney Bowes 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

80

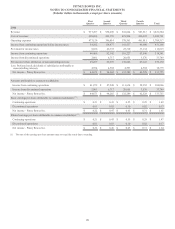

15. Income Taxes

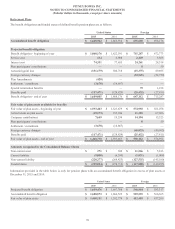

Income from continuing operations before taxes consisted of the following:

Years Ended December 31,

2015 2014 2013

U.S. $ 516,233 $ 356,017 $ 288,660

International 94,592 75,179 95,294

Total $ 610,825 $ 431,196 $ 383,954

The provision for income taxes from continuing operations consisted of the following:

Years Ended December 31,

2015 2014 2013

U.S. Federal:

Current $ 115,557 $ 71,683 $ 78,315

Deferred 19,941 6,941 (19,754)

135,498 78,624 58,561

U.S. State and Local:

Current 11,243 7,186 5,359

Deferred 16,094 (9,307) (8,026)

27,337 (2,121) (2,667)

International:

Current 22,794 32,492 28,063

Deferred 4,149 3,820 (5,990)

26,943 36,312 22,073

Total current 149,594 111,361 111,737

Total deferred 40,184 1,454 (33,770)

Total provision for income taxes $ 189,778 $ 112,815 $ 77,967

Effective tax rate 31.1% 26.2% 20.3%

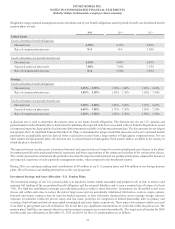

The effective tax rate for 2015 includes tax benefits of $20 million from the disposition of Imagitas and $3 million from the retroactive

effect of 2015 tax legislation.

The effective tax rate for 2014 includes tax benefits of $22 million from the resolution of tax examinations and $5 million from the

retroactive effect of 2014 U.S. tax legislation.

The effective tax rate for 2013 includes tax benefits of $13 million from an affiliate reorganization, $17 million from tax planning initiatives

and $5 million from the adjustment of non-U.S. tax accounts from prior periods and the retroactive effect of 2013 U.S. tax legislation.