Pitney Bowes 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

67

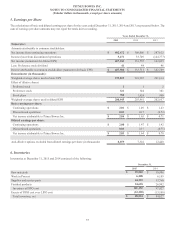

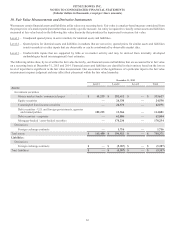

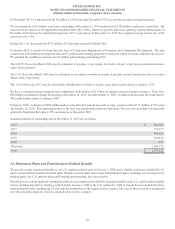

The following represents the results of our non-designated derivative instruments for the years ended December 31, 2015 and 2014:

Year Ended December 31,

Derivative Gain (Loss)

Recognized in Earnings

Derivatives Instrument Location of Derivative Gain (Loss) 2015 2014

Foreign exchange contracts Selling, general and administrative expense $(6,849)$ (4,701)

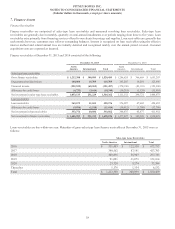

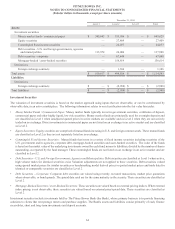

Credit-Risk-Related Contingent Features

Certain derivative instruments contain credit-risk-related contingent features that would require us to post collateral based on a combination

of our long-term senior unsecured debt ratings and the net fair value of our derivatives. At December 31, 2015, the maximum amount of

collateral that we would have been required to post had the credit-risk-related contingent features been triggered was $5 million.

Fair Value of Financial Instruments

Our financial instruments include cash and cash equivalents, investment securities, accounts receivable, loan receivables, derivative

instruments, accounts payable and debt. The carrying value for cash and cash equivalents, accounts receivable, loans receivable, and

accounts payable approximate fair value because of the short maturity of these instruments.

The fair value of our debt is estimated based on recently executed transactions and market price quotations. The inputs used to determine

the fair value of our debt were classified as Level 2 in the fair value hierarchy. The carrying value and estimated fair value of our debt at

December 31, 2015 and 2014 was as follows:

December 31,

2015 2014

Carrying value $ 2,968,997 $ 3,252,006

Fair value $ 3,102,890 $ 3,440,383

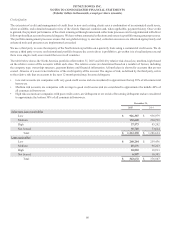

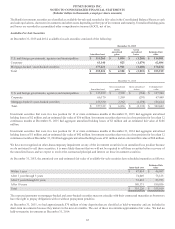

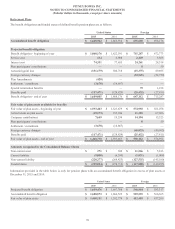

11. Supplemental Balance Sheet Information

The following table shows selected balance sheet information at December 31, 2015 and 2014:

December 31,

2015 2014

Other assets:

Long-term investments $ 327,282 $ 332,452

Deferred charges 125,190 149,092

Other 91,749 95,579

Total $ 544,221 $ 577,123

Accounts payable and accrued liabilities:

Accounts payable $ 302,113 $ 268,527

Customer deposits 665,339 661,167

Employee related liabilities 255,893 319,963

Miscellaneous other 224,976 323,314

Total $ 1,448,321 $ 1,572,971