Pitney Bowes 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

70

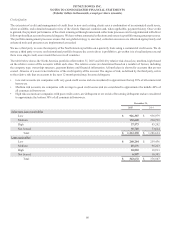

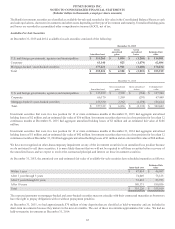

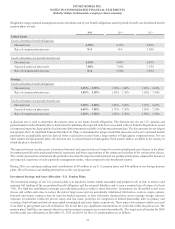

Retirement Plans

The benefit obligations and funded status of defined benefit pension plans are as follows:

United States Foreign

2015 2014 2015 2014

Accumulated benefit obligation $ 1,688,982 $ 1,866,914 $ 635,600 $ 698,176

Projected benefit obligation

Benefit obligation - beginning of year $ 1,868,176 $ 1,622,591 $ 715,287 $ 672,773

Service cost 134 6,908 2,229 3,565

Interest cost 74,331 77,655 24,261 28,518

Plan participants' contributions ——859

Actuarial (gain) loss (131,179)306,718 (15,375)89,695

Foreign currency changes ——(53,945)(52,750)

Plan Amendments (428)———

Settlement / curtailment (3,678)(16,867)——

Special termination benefits ——79 1,238

Benefits paid (117,471)(128,829)(25,432)(27,811)

Benefit obligation - end of year $ 1,689,885 $ 1,868,176 $ 647,112 $ 715,287

Fair value of plan assets available for benefits

Fair value of plan assets - beginning of year $ 1,593,463 $ 1,523,679 $ 574,992 $ 561,078

Actual return on plan assets (19,173)195,946 11,383 67,306

Company contributions 7,649 19,534 14,194 15,323

Plan participants' contributions ——859

Settlement / curtailment (3,678)(16,867)——

Foreign currency changes ——(45,033)(40,963)

Benefits paid (117,471)(128,829)(25,432)(27,811)

Fair value of plan assets - end of year $ 1,460,790 $ 1,593,463 $ 530,112 $ 574,992

Amounts recognized in the Consolidated Balance Sheets

Non-current asset $ 271 $ 300 $ 11,566 $ 5,813

Current liability (9,088)(6,590)(1,031)(1,008)

Non-current liability (220,277)(268,423)(127,535)(145,100)

Funded status $(229,094)$(274,713)$(117,000)$ (140,295)

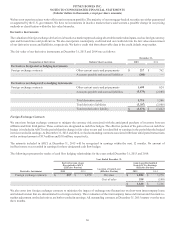

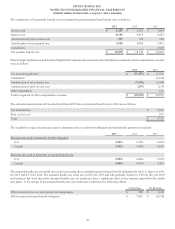

Information provided in the table below is only for pension plans with an accumulated benefit obligation in excess of plan assets at

December 31, 2015 and 2014:

United States Foreign

2015 2014 2015 2014

Projected benefit obligation $ 1,689,476 $ 1,867,788 $ 540,984 $ 583,317

Accumulated benefit obligation $ 1,688,573 $ 1,866,525 $ 529,593 $ 566,365

Fair value of plan assets $ 1,460,111 $ 1,592,774 $ 412,418 $ 437,209