Pitney Bowes 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

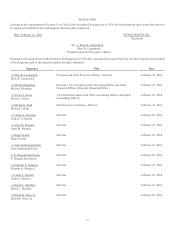

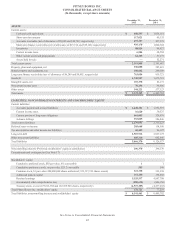

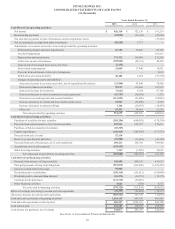

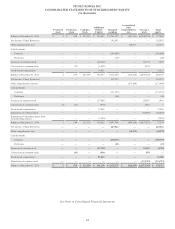

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

47

value of the reporting unit. The excess of the fair value of the reporting unit over the amounts assigned to its assets and liabilities is

referred to as the implied fair value of goodwill. The implied fair value of the reporting unit's goodwill is then compared to the actual

carrying value of goodwill. If the implied fair value of goodwill is less than the carrying value of goodwill, an impairment loss is recognized

for the difference. The fair value of a reporting unit is determined based on a combination of various techniques, including the present

value of future cash flows, multiples of competitors and multiples from sales of like businesses.

Retirement Plans

Net periodic benefit cost includes current service cost, interest cost, expected return on plan assets and the amortization of actuarial gains

and losses. Actuarial gains and losses arise from actual experiences that differ from previous assumptions as well as changes in assumptions

including expected return on plan assets, discount rates used to measure pension and other postretirement obligations and life expectancy.

The expected return on assets is measured using the market-related value of assets, which is a calculated value that recognizes changes

in the fair value of plan assets over five years. Actuarial gains and losses are recognized in other comprehensive income, net of tax, and

amortized to benefit cost over the life expectancy of inactive plan participants. The funded status of pension and other postretirement

benefit plans is recognized in the Consolidated Balance Sheets.

Stock-based Compensation

We measure compensation expense for stock-based awards based on the estimated fair value of the awards expected to vest (net of

estimated forfeitures) and recognize the expense on a straight-line basis over the requisite service period. The fair value of stock awards

is estimated using a Black-Scholes valuation model or a Monte Carlo simulation model. These models require assumptions be made

regarding the expected stock price volatility, risk-free interest rate, life of the award and dividend yield. The expected stock price volatility

is based on historical price changes of our stock. The risk-free interest rate is based on U.S. Treasuries with a term equal to the expected

life of the stock award. The expected life of the award and expected dividend yield are based on historical experience. We believe that

the valuation techniques and underlying assumptions are appropriate in estimating the fair value of stock awards.

Revenue Recognition

We derive revenue from multiple sources including sales, rentals, financing and services. Certain transactions are consummated at the

same time and can therefore generate revenue from multiple sources. The most common form of these transactions involves a sale or

non-cancelable lease of equipment, a meter rental and an equipment maintenance agreement. In these multiple element arrangements,

revenue is allocated to each of the elements based on relative "selling prices" and the selling price for each of the elements is determined

based on vendor specific objective evidence (VSOE). We establish VSOE of selling prices for our products and services based on the

prices charged for each element when sold separately in standalone transactions. The allocation of relative selling price to the various

elements impacts the timing of revenue recognition, but does not change the total revenue recognized. Revenue is allocated to the meter

rental and equipment maintenance agreement elements using their respective selling prices charged in standalone and renewal transactions.

For a sale transaction, revenue is allocated to the equipment based on a range of selling prices in standalone transactions. For a lease

transaction, revenue is allocated to the equipment based on the present value of the remaining minimum lease payments. The amount

allocated to equipment is compared to the range of selling prices in standalone transactions during the period to ensure the allocated

equipment amount approximates average selling prices. More specifically, revenue related to our offerings is recognized as follows:

Sales Revenue

Sales of Equipment

We sell equipment directly to our customers and to distributors (re-sellers) throughout the world. We recognize revenue from these sales

when the risks and rewards of ownership transfer to the client, which is generally upon shipment or acceptance by the customer. We

recognize revenue from the sale of equipment under sales-type leases as equipment sales revenue at the inception of the lease. We do not

typically offer any rights of return or stock balancing rights. Sales revenue from customized equipment, mail creation equipment and

shipping products is generally recognized when installed.

Sales of Supplies

Revenue related to supplies is generally recognized upon delivery.

Standalone Software Sales and Integration Services

We also have multiple element arrangements containing only software and software related elements. Software related elements may

include maintenance and support services, data subscriptions, training and integration services. Under these multiple element

arrangements, we allocate revenue based on VSOE for software related elements and use the residual method to determine the amount

of software licenses revenue. Under the residual method, the fair-value of the undelivered elements is deferred and the remaining portion

of the arrangement consideration is allocated to the delivered elements and recognized as revenue. The majority of our software license