Pitney Bowes 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

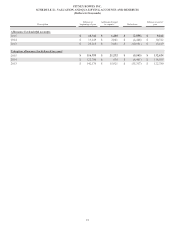

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

82

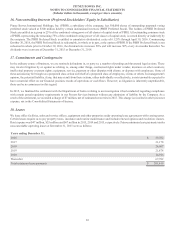

We have net operating loss carryforwards of $310 million as of December 31, 2015, of which, $251 million can be carried forward

indefinitely and the remainder expire over the next 15 years. In addition, we have tax credit carryforwards of $54 million, of which $39

million can be carried forward indefinitely and the remainder expire over the next 10 to 15 years.

As of December 31, 2015 we have not provided for income taxes on $860 million of cumulative undistributed earnings of subsidiaries

outside the U.S. as these earnings will be either indefinitely reinvested or remitted substantially free of additional tax. However, we

estimate that withholding taxes on such remittances would be $13 million. Determination of the liability that would be incurred if these

earnings were remitted to the U.S. is not practicable as there is a significant amount of uncertainty with respect to determining the amount

of foreign tax credits and other indirect tax consequences that may arise from the distribution of these earnings.

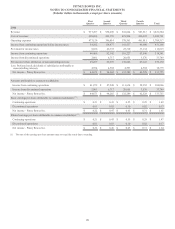

Uncertain Tax Positions

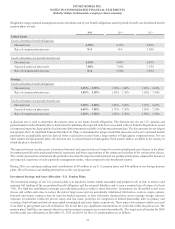

A reconciliation of the amount of unrecognized tax benefits is as follows:

2015 2014 2013

Balance at beginning of year $ 132,495 $ 172,594 $ 151,098

Increases from prior period positions 7,637 9,090 15,777

Decreases from prior period positions (16,753)(33,692) (6,908)

Increases from current period positions 23,533 17,704 23,549

Decreases relating to settlements with tax authorities (3,831)(22,127) (482)

Reductions from lapse of applicable statute of limitations (3,832)(11,074) (10,440)

Balance at end of year $ 139,249 $ 132,495 $ 172,594

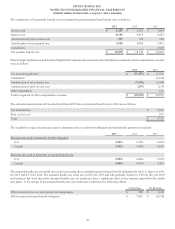

The amount of the unrecognized tax benefits at December 31, 2015, 2014 and 2013 that would affect the effective tax rate if recognized

was $117 million, $109 million and $148 million, respectively.

On a regular basis, we conclude tax return examinations, statutes of limitations expire, and court decisions interpret tax law. We regularly

assess tax uncertainties in light of these developments. As a result, it is reasonably possible that the amount of our unrecognized tax

benefits will decrease in the next 12 months, and we expect this change could be up to 15% of our unrecognized tax benefits. We recognize

interest and penalties related to uncertain tax positions in our provision for income taxes. We recognized interest and penalties of $(4)

million, $2 million and $27 million related to uncertain tax positions in our provision for income taxes for the years ended December 31,

2015, 2014 and 2013, respectively. We had $10 million and $11 million accrued for the payment of interest and penalties at December 31,

2015 and 2014, respectively.

Other Tax Matters

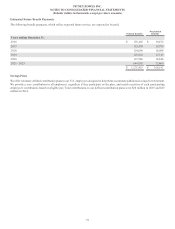

As is the case with other large corporations, our tax returns are examined each year by tax authorities in the U.S. and other global taxing

jurisdictions in which we have operations. The IRS examinations of our consolidated U.S. income tax returns for tax years prior to 2012

are closed to audit. Additionally, in the U.S. we are subject to examination on various post-2005 State and Local taxes. In Canada, the

examination of our tax filings prior to 2009 are closed to audit, except for the pending application of legal principles to specific issues

arising in earlier years. Other significant jurisdictions in which we have, or have recently completed, tax examinations include France,

closed through the end of 2012, Germany closed through the end of 2011 and except for an item under appeal the U.K. closed through

the end of 2011. We have other less significant tax filings currently subject to examination.

We regularly assess the likelihood of tax adjustments in each of the tax jurisdictions in which we have operations and account for the

related financial statement implications. We believe we have established tax reserves that are appropriate given the possibility of tax

adjustments. However, determining the appropriate level of tax reserves requires judgment regarding the uncertain application of tax law

and the possibility of tax adjustments. Future changes in tax reserve requirements could have a material impact, positive or negative, on

our results of operations, financial position and cash flows.