Pitney Bowes 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

75

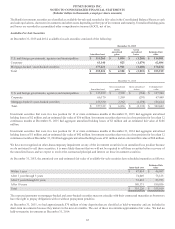

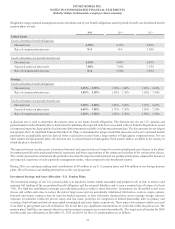

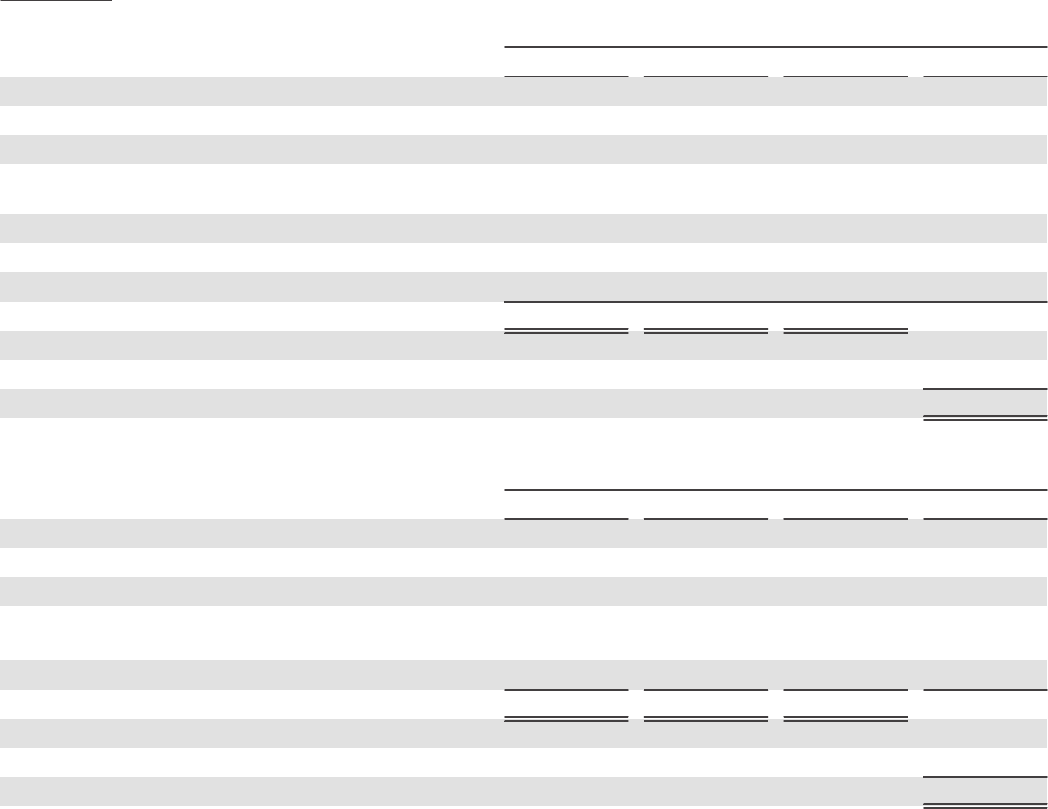

Foreign Plans

December 31, 2015

Level 1 Level 2 Level 3 Total

Money market funds $ — $ 7,596 $ — $ 7,596

Equity securities 33,855 183,110 — 216,965

Commingled fixed income securities — 138,220 — 138,220

Debt securities - U.S. and foreign governments, agencies and

municipalities — 73,573 — 73,573

Debt securities - corporate — 27,279 — 27,279

Real estate — — 39,177 39,177

Diversified growth funds — — 20,513 20,513

Total plan assets at fair value $ 33,855 $ 429,778 $ 59,690 $ 523,323

Cash 6,376

Other 413

Fair value of plan assets available for benefits $ 530,112

December 31, 2014

Level 1 Level 2 Level 3 Total

Money market funds $ — $ 6,684 $ — $ 6,684

Equity securities 99,570 190,924 — 290,494

Commingled fixed income securities — 151,017 — 151,017

Debt securities - U.S. and foreign governments, agencies and

municipalities — 85,711 — 85,711

Debt securities - corporate — 26,154 — 26,154

Total plan assets at fair value $ 99,570 $ 460,490 $ — $ 560,060

Cash 10,859

Other 4,073

Fair value of plan assets available for benefits $ 574,992

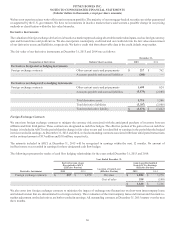

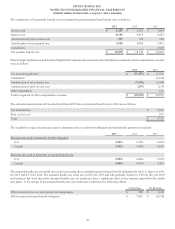

The following information relates to our classification of investments into the fair value hierarchy:

• Money Market Funds: Money market funds typically invest in government securities, certificates of deposit, commercial paper of

companies and other highly liquid, low risk securities. Money market funds are principally used for overnight deposits. They are

classified as Level 2 since they are not actively traded on an exchange.

• Equity Securities: Equity securities include U.S. and foreign common stock, American Depository Receipts, preferred stock and

commingled funds. Equity securities classified as Level 1 are valued using active, high volume trades for identical securities. Equity

securities classified as Level 2 represent those not listed on an exchange in an active market. These securities are valued based on

quoted market prices of similar securities.

• Commingled Fixed Income Securities: Mutual funds that invest in a variety of fixed income securities including securities of the

U.S. government and its agencies, corporate debt, mortgage-backed securities and asset-backed securities. Value of the funds is based

on the net asset value (NAV) per unit as reported by the fund manager. NAV is based on the market value of the underlying investments

owned by each fund, minus its liabilities, divided by the number of shares outstanding. Commingled fixed income securities are not

listed on an active exchange and are classified as Level 2.

• Debt Securities - U.S. and Foreign Governments, Agencies and Municipalities: Government securities include treasury notes and

bonds, foreign government issues, U.S. government sponsored agency debt and commingled funds. Municipal debt securities include

general obligation securities and revenue-backed securities. Debt securities classified as Level 1 are valued using active, high volume