Pitney Bowes 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

84

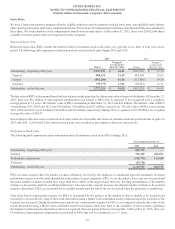

19. Stockholders' Equity

Preferred and Preference Stock

We have two classes of preferred stock issued and outstanding: the 4% Preferred Stock (the Preferred Stock) and the $2.12 Preference

Stock (the Preference Stock). The Preferred Stock is entitled to cumulative dividends of $2 per year and can be converted into 24.24

shares of common stock, subject to adjustment, in certain events. The Preferred Stock is redeemable at our option at a price of $50 per

share, plus dividends accrued through the redemption date. We are authorized to issue 600,000 shares of Preferred Stock. At December 31,

2015 and 2014, there were 12 shares and 24 shares outstanding, respectively. There are no unpaid dividends in arrears.

The Preference Stock is entitled to cumulative dividends of $2.12 per year and can be converted into 16.53 shares of common stock,

subject to adjustment, in certain events. The Preference Stock is redeemable at our option at a price of $28 per share. We are authorized

to issue 5,000,000 shares of Preference Stock. At December 31, 2015 and 2014, there were 18,660 shares and 20,237 shares outstanding,

respectively. There are no unpaid dividends in arrears.

Common and Treasury Stock

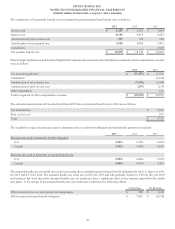

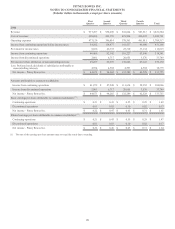

The following table summarizes the changes in shares of Common Stock outstanding and Treasury Stock:

Common Stock

Outstanding Treasury Stock

Balance at December 31, 2012 200,884,047 122,453,865

Issuance of common stock 1,163,668 (1,163,668)

Conversions to common stock 34,807 (34,807)

Balance at December 31, 2013 202,082,522 121,255,390

Repurchases of common stock (1,863,262) 1,863,262

Issuance of common stock 781,032 (781,032)

Conversions to common stock 27,672 (27,672)

Balance at December 31, 2014 201,027,964 122,309,948

Repurchases of common stock (6,476,796) 6,476,796

Issuance of common stock 943,686 (943,686)

Conversions to common stock 26,354 (26,354)

December 31, 2015 195,521,208 127,816,704

At December 31, 2015, 35,377,289 shares were reserved for issuance under our stock plans, dividend reinvestment program and the

conversion of Preferred Stock and Preference Stock.