Pitney Bowes 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

69

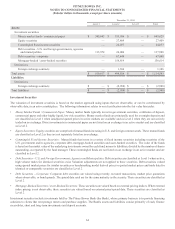

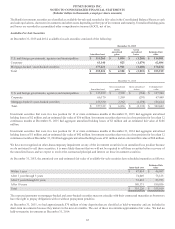

In November 2015 we redeemed the $110 million 5.250% notes due November 2022 at a par plus accrued and unpaid interest.

We also repaid the $130 million term loans outstanding at December 31, 2014 and borrowed $150 million under new a term loan. The

term loan bears interest at the applicable Eurodollar Rate plus 0.90%. Interest is payable and resets quarterly and the loans mature in

December 2016 but may be extended through June 2017 at our option. At December 31, 2015, the weighted-average interest rate of the

term loans was 1.4%.

During 2015, we also repaid the $275 million, 5% notes that matured in March 2015.

In October 2014, we received a loan from the State of Connecticut Department of Economic and Community Development. The loan

consisted of a $15 million development loan and $1 million jobs-training grant that is subject to refund if certain conditions are not met.

We satisfied the conditions related to the $1 million jobs-training grant during 2015.

The 4.625% Notes due March 2024 may be redeemed, at anytime, at our option, in whole or in part, at par plus accrued interest and a

make-whole payment.

The 6.7% Notes due March 2043 may be redeemed, at our option, in whole or in part, at par plus accrued interest any time on or after

March 2018, respectively.

The 5.25% Notes due 2037 may be redeemed by bondholders, in whole or in part, at par plus accrued interest in January 2017.

We have a commercial paper program and a committed credit facility of $1 billion to support commercial paper issuances. There were

$90 million of commercial paper borrowings at December 31, 2015. As of December 31, 2015, we had not drawn upon the credit facility.

The credit facility expires in January 2020.

In January 2016, we borrowed $300 million under a term loan and used the proceeds to repay a portion of the $371 million, 4.75% notes

due January 15, 2016. The remaining portion of the loan was repaid using cash from operations. The new term loan bears interest at the

applicable Eurodollar Rate plus 1.25% and matures in December 2020.

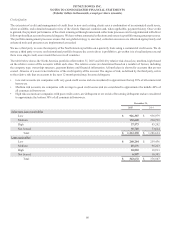

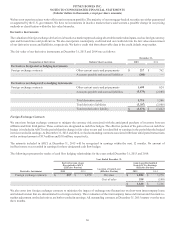

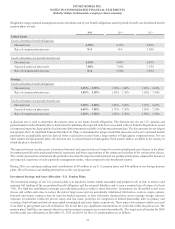

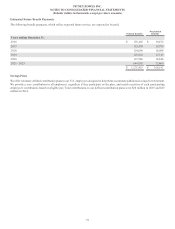

Annual maturities of outstanding debt at December 31, 2015 are as follows:

2016 $ 461,085

2017 535,277

2018 600,168

2019 300,168

2020 412

Thereafter 1,054,712

Total $ 2,951,822

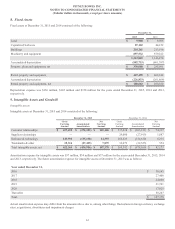

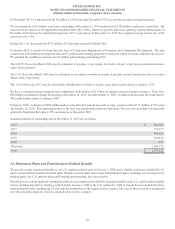

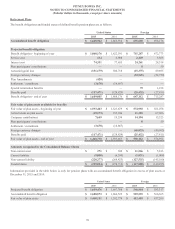

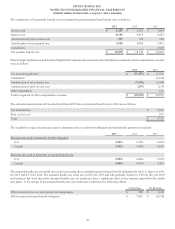

14. Retirement Plans and Postretirement Medical Benefits

We provide certain retirement benefits to our U.S. employees hired prior to January 1, 2005 and to eligible employees outside the U.S.

under various defined benefit retirement plans. Benefit accruals under most of our defined benefit plans, including our two largest U.S.

pension plans, our U.K. pension plans and Canadian pension plans, have been frozen.

We also provide certain employer subsidized health care and employer provided life insurance benefits in the U.S. and Canada to eligible

retirees and their dependents. Employees hired before January 1, 2005 in the U.S. and April 1, 2005 in Canada become eligible for retiree

medical benefits after reaching age 55 and with the completion of the required service period. The cost of these benefits is recognized

over the period the employee provides credited service to the company.