Pitney Bowes 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

73

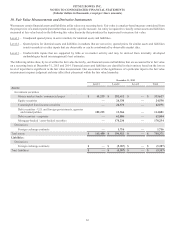

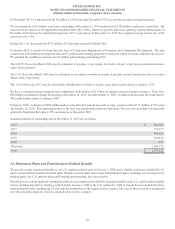

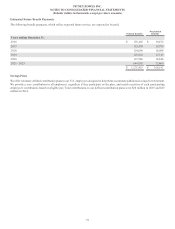

Target

allocation

Percent of Plan Assets at

December 31,

2016 2015 2014

Asset category

U.S. equities 15% 12% 12%

Non-U.S. equities 15% 10% 9%

Fixed income 60% 68% 69%

Real estate 5% 6% 5%

Private equity 5% 4% 5%

Total 100% 100% 100%

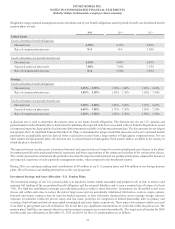

Investment Strategy and Asset Allocation - Foreign Pension Plans

Our foreign pension plan assets are managed by outside investment managers and monitored regularly by local trustees and our corporate

personnel. Investment strategies vary by country and plan, with each strategy tailored to achieve the expected rate of return within an

acceptable or appropriate level of risk, depending upon the liability profile of plan participants, local funding requirements, investment

markets and restrictions. The U.K. plan represents 75% of the non-U.S. pension assets. The U.K. pension plan's investment strategy is

to maximize returns within reasonable and prudent levels of risk, to achieve and maintain full funding of the accumulated benefit obligation

and the actuarial liabilities and to earn a nominal rate of return of at least 6.5%. The fund has established a strategic asset allocation policy

to achieve these objectives. Investments are diversified across asset classes and within each class to minimize the risk of large losses and

are periodically rebalanced. Derivatives, such as swaps, options, forwards and futures contracts may be used for market exposure, to alter

risk/return characteristics and to manage currency exposure. We do not have any significant concentrations of credit risk within the plan

assets. The pension plans' liabilities, investment objectives and investment managers are reviewed periodically. The target asset allocation

for 2016 and the actual asset allocations at December 31, 2015 and 2014, for the U.K. pension plan are as follows:

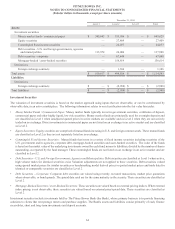

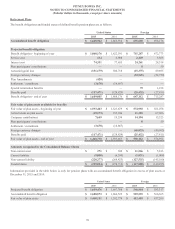

Target

Allocation

Percent of Plan Assets at

December 31,

2016 2015 2014

Asset category

U.K. equities 20% 23% 28%

Non-U.K. equities 20% 20% 29%

Fixed income 40% 40% 40%

Real estate 10% 10% —%

Diversified growth 10% 5% —%

Cash —% 2% 3%

Total 100% 100% 100%

The target asset allocation used to manage the investment portfolios is based on the broad asset categories shown above. The plan asset

categories presented in the fair value hierarchy are subsets of the broad asset categories.

The fair value of the U.K. plan assets was $399 million and $427 million at December 31, 2015 and 2014, respectively, and the expected

long-term weighted average rate of return on these plan assets was 7.00% in 2015 and 7.50% in 2014.

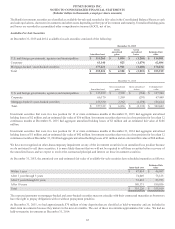

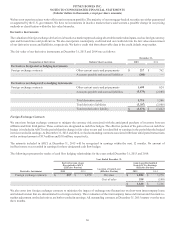

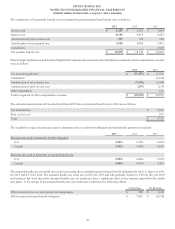

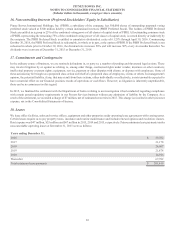

Fair Value Measurements of Plan Assets

The following tables show, by level within the fair value hierarchy, the financial assets and liabilities that are accounted for at fair value

on a recurring basis at December 31, 2015 and 2014, respectively, for the U.S. and foreign pension plans. Financial assets and liabilities

are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Our assessment of the

significance of a particular input to the fair value measurement requires judgment and may affect placement within the fair value hierarchy

levels. There are no shares of our common stock included in the plan assets of our pension plans.