Pitney Bowes 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

68

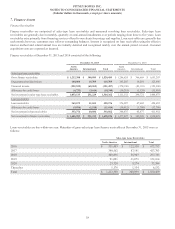

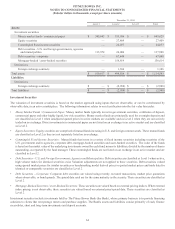

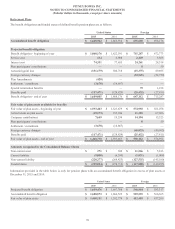

12. Restructuring Charges and Asset Impairments

The table below shows the activity in our restructuring reserves for the years ended December 31, 2015 and 2014:

Severance and

benefits costs

Other exit

costs Total

Balance at December 31, 2013 $ 58,558 $ 8,014 $ 66,572

Expenses, net 74,325 5,444 79,769

Cash payments (51,047)(5,115) (56,162)

Balance at December 31, 2014 81,836 8,343 90,179

Expenses, net 19,078 251 19,329

Cash payments (57,214)(4,872) (62,086)

Balance at December 31, 2015 $ 43,700 $ 3,722 $ 47,422

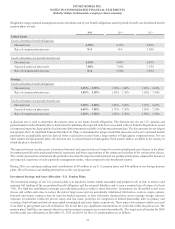

The majority of the remaining restructuring reserves are expected to be paid over the next 12-24 months. Due to certain international

labor laws and long-term lease agreements, some payments will extend beyond 24 months. We expect to fund these payments from cash

flows from operations.

Asset impairment

During 2015, we sold our world headquarters building for $39 million and recorded a loss on the sale of $5 million. The loss was recognized

in restructuring charges and asset impairments, net in the Consolidated Statements of Income.

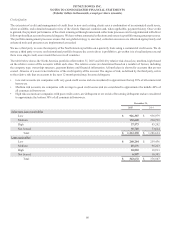

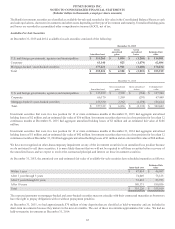

13. Debt

December 31,

Interest rate 2015 2014

Commercial paper 1.1% $ 90,000 $—

Notes due March 2015 5.0% —274,879

Notes due January 2016 4.75% 370,914 370,914

Notes due September 2017 5.75% 385,109 385,109

Notes due March 2018 5.6% 250,000 250,000

Notes due May 2018 4.75% 350,000 350,000

Notes due March 2019 6.25% 300,000 300,000

Notes due November 2022 5.25% —110,000

Notes due March 2024 4.625% 500,000 500,000

Notes due January 2037 5.25% 115,041 115,041

Notes due March 2043 6.7% 425,000 425,000

Term loans Variable 150,000 130,000

Other debt 15,758 16,000

Principal amount 2,951,822 3,226,943

Less: unamortized discount 5,288 6,653

Plus: unamortized interest rate swap proceeds 22,463 31,716

Total debt 2,968,997 3,252,006

Less: current portion long-term debt 461,085 324,879

Long-term debt $ 2,507,912 $ 2,927,127