Pitney Bowes 2015 Annual Report Download - page 66

Download and view the complete annual report

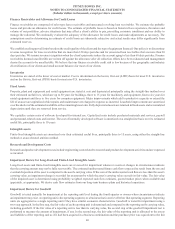

Please find page 66 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

50

judgment. Estimates of potential liabilities for claims or legal actions are based only on information that is available at that time. As

additional information becomes available, we may revise our estimates, and these revisions could have a material impact on our results

of operations and financial position. Legal fees are expensed as incurred.

Reclassification

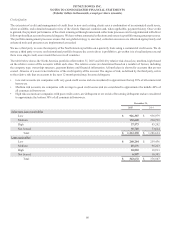

In 2015, we determined that certain investments were classified as cash and cash equivalents. Accordingly, the Consolidated Balance

Sheet at December 2014 has been revised to reduce cash and cash equivalents by $25 million, and increase short-term investments by

$17 million and other assets by $8 million. Additionally, the Consolidated Statements of Cash Flows for the years ended December 31,

2014 and 2013 have also been revised to reduce cash and cash equivalents and increase short-term investments and other assets for certain

investment accounts.

During 2015, we determined that certain customer deposits at December 31, 2014 within current liabilities should have been classified

as either a current asset or a non-current liability. Accordingly, the Consolidated Balance Sheet at December 31, 2014 has been revised

by increasing accounts receivable by $23 million, accounts payable and accrued liabilities by $14 million and other non-current liabilities

by $9 million.

New Accounting Pronouncements

In November 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standard Update (ASU) 2015-17, Balance

Sheet Classification of Deferred Taxes, which requires all deferred tax assets and liabilities to be presented as noncurrent in the balance

sheet. The ASU is effective for interim and annual periods beginning after December 15, 2016, and can be applied either prospectively

or retrospectively. Early adoption is permitted. We have elected to retrospectively adopt this ASU effective December 31, 2015.

Accordingly, the Consolidated Balance Sheet at December 31, 2014 has been revised by reducing current income tax assets by $12 million

and current income tax liabilities by $60 million and increasing noncurrent income taxes by $2 million and deferred taxes on income by

$50 million.

In September 2015, the FASB issued ASU 2015-16, Business Combinations - Simplifying the Accounting for Measurement-Period

Adjustments, which eliminates the requirement to restate prior period financial statements for measurement period adjustments. The new

guidance requires that the cumulative impact of a measurement period adjustment (including the impact on prior periods) be recognized

in the reporting period in which the adjustment is identified. Consistent with existing guidance, the new guidance requires an acquirer

to disclose the nature and amount of measurement period adjustments. The ASU is effective for interim and annual periods beginning

after December 15, 2015 and requires that measurement period adjustments be applied prospectively. Early adoption is permitted. We

will adopt this standard in the first quarter of 2016 and currently do not expect the adoption of this standard will have a significant impact

on our consolidated financial statements or disclosures.

In July 2015, the FASB issued ASU 2015-11, Inventory - Simplifying the Measurement of Inventory, which requires inventory to be

measured at the lower of cost and net realizable value (estimated selling price less reasonably predictable costs of completion, disposal

and transportation). Prior to this guidance, inventory was measured at the lower of cost or market (where market was defined as replacement

cost, with a ceiling of net realizable value and a floor of net realizable value of inventory, less a normal profit margin). Inventory measured

using LIFO is not impacted by the new guidance. The ASU is effective for fiscal years beginning after December 15, 2016 and interim

periods therein. Early adoption is permitted. We do not believe this standard will have a significant impact on our consolidated financial

statements or disclosures.

In April 2015, the FASB issued ASU 2015-05, Intangibles - Goodwill and Other - Internal-Use Software, Customer's Accounting for

Fees Paid in a Cloud Computing Arrangement, which provides guidance on fees paid by an entity in a cloud computing arrangement

and whether an arrangement includes a license to the underlying software. This standard is effective for fiscal periods beginning after

December 15, 2015. We will adopt this standard in the first quarter of 2016 and the adoption of this standard will not have a significant

impact on our consolidated financial statements or disclosures.

In April 2015, the FASB issued ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs, which requires debt issuance costs

to be presented in the balance sheet as a direct deduction from the associated debt liability. This standard is effective for fiscal periods

beginning after December 15, 2015. We will adopt this standard in the first quarter of 2016. Upon adoption, debt issuance costs currently

recorded as other assets in the Consolidated Balance Sheets will be reclassified as a reduction in long-term debt. At December 31, 2015,

debt issuance costs included in other assets in the Consolidated Balance Sheet was $18 million.

In January 2015, the FASB issued ASU 2015-01, Income Statement - Extraordinary and Unusual Items, which removes the concept of

extraordinary items, thereby eliminating the need for companies to assess transactions for extraordinary treatment. The standard retained

the presentation and disclosure requirements for items that are unusual in nature and/or infrequent in occurrence. The standard is effective