Pitney Bowes 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The following discussion and analysis should be read in conjunction with our consolidated financial statements and related notes. This

discussion and analysis contains forward-looking statements based on management's current expectations, estimates and projections and

involve risks and uncertainties. Our actual results may differ significantly from those currently expressed in our forward-looking statements

as a result of various factors, including those factors described under "Forward-Looking Statements" and "Risk Factors" contained

elsewhere in this Annual Report. All table amounts are presented in thousands of dollars, unless otherwise stated.

Overview

During 2015, we continued to execute on our strategic priorities to stabilize our mail business, drive operational excellence and grow

our business through digital commerce. We expanded our marketing efforts to build awareness of our unique capabilities and refreshed

our brand identity, completed our transition to a larger inside sales organization (part of our changes in our go-to-market strategy) in

major markets, launched several new products and repositioned our portfolio through acquisitions and divestitures. We acquired a provider

of cross-border ecommerce solutions through a proprietary technology and services platform that enables retailers to transact with

consumers around the world, a provider of technology that enables clients to provide personalized interactive video communications to

their customers, and expanded our presort sites. We also sold our marketing services business, Imagitas, and exited certain geographic

markets as part of our initiative to simplify our geographic footprint. We also continued to reduce costs through our restructuring initiatives

and worked to implement our new global enterprise resource planning (ERP) system, which was launched in Canada in the fourth quarter

of 2015.

The U.S. dollar remained strong against other currencies throughout the year, which adversely affected our reported revenues and

profitability, both from a translation perspective as well as a competitive perspective, as the cost of our international competitors’ products

and solutions improved relative to products and solutions manufactured or sold from the U.S. The current strength of the dollar relative

to other currencies also affected demand for U.S. goods sold to consumers in other countries through our global ecommerce operations.

In the second quarter, we acquired Borderfree and sold Imagitas. As a result we realigned our segment reporting. Our business continues

to be organized around three distinct sets of solutions - Small and Medium Business (SMB) Solutions, Enterprise Business Solutions and

Digital Commerce Solutions (DCS). There were no changes to SMB Solutions or Enterprise Business Solutions. Within DCS, we now

report Software Solutions and Global Ecommerce as reportable segments. Imagitas, previously included in DCS, is now reported in Other.

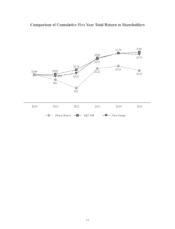

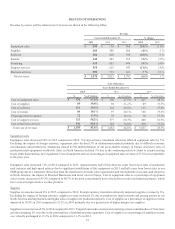

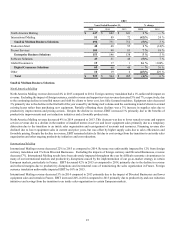

Revenue for 2015 decreased 6% to $3,578 million compared to $3,822 million in 2014. Revenue was negatively impacted by 3% due

to foreign currency translation, 2% from the sale of Imagitas and 1% from the exit of non-core product lines in Norway and the transition

in certain European countries to a dealer network in the third quarter of 2014 (Divested Businesses). Revenue benefited by 2% from the

acquisition of Borderfree.

On a reported basis, equipment sales declined 10%, support services declined 11%, software declined 10%, rentals revenue declined 9%,

financing declined 5% and supplies declined 4%. Partially offsetting these declines, was revenue growth in business services of 3%.

Excluding the impacts of foreign currency, equipment sales declined 5%, primarily due to continued weakness in our international markets

reflecting difficult economic circumstances and productivity disruptions caused by the implementation of our go-to-market strategy

primarily in France. Support services revenue declined 7% and rentals revenue declined 6% due to fewer mailing machines in service

and a shift by customers to lower cost, less featured mailing machines. Support services revenue was also impacted by lower maintenance

contracts on production mail equipment as some in-house mailers moved their mail processing to third-party service bureaus who service

some of their own equipment. Software revenue declined 5% primarily due to the inclusion of significant North America licensing deals

in 2014. These declines were partially offset by revenue growth in business services of 3% primarily due to the acquisition of Borderfree

and higher volumes of mail processed in presort services.

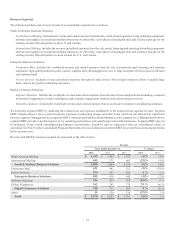

Looking at our operating segments, SMB Solutions revenue declined 9% primarily due to the unfavorable impact from foreign currency

translation of 4%, the continuing decline in installed meters and shift by clients to lower cost, less fully featured machines and declines

in our international mailing operations due to difficult economic circumstances and productivity disruptions. Enterprise Business Solutions

revenue decreased 3%, primarily due to the unfavorable impact from currency translation of 3% and lower service revenue in Production

Mail, partially offset by increased volumes in Presort Services. DCS revenue increased 5% primarily due to the acquisition of Borderfree

and higher volume of packages shipped from our U.K. outbound cross-border service facility, which began in the fourth quarter of 2014,

partially offset by lower software licensing revenue due to the inclusion of significant large licensing deals in 2014.