Pitney Bowes 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

76

trades for identical securities. Debt securities classified as Level 2 are valued through benchmarking model derived prices to quoted

market prices and trade data for identical or comparable securities.

• Debt Securities – Corporate: Investments are comprised of both investment grade debt

and high-yield debt The

fair value of corporate debt securities is valued using recently executed transactions, market price quotations where observable, or

bond spreads. The spread data used are for the same maturity as the security. These securities are classified as Level 2.

• Mortgage-Backed Securities (MBS): Investments are comprised of agency-backed MBS, non-agency MBS, collateralized mortgage

obligations, commercial MBS, and commingled funds. These securities are valued based on external pricing indices. When external

index pricing is not observable, MBS are valued based on external price/spread data. If neither pricing method is available, broker

quotes are utilized. When inputs are observable and supported by an active market, MBS are classified as Level 2 and when inputs

are unobservable, MBS are classified as Level 3.

• Asset-Backed Securities (ABS): Investments are primarily comprised of credit card receivables, auto loan receivables, student loan

receivables, and Small Business Administration loans. These securities are valued based on external pricing indices or external price/

spread data and are classified as Level 2.

• Private Equity: Investments are comprised of units in fund-of-funds investment vehicles. Fund-of-funds consist of various private

equity investments and are used in an effort to gain greater diversification. The investments are valued in accordance with the most

appropriate valuation techniques, and are classified as Level 3 due to the unobservable inputs used to determine a fair value.

• Real Estate: Investments include units in open-ended commingled real estate funds. Properties that comprise these funds are valued

in accordance with the most appropriate valuation techniques, and are classified as Level 3 due to the unobservable inputs used to

determine a fair value.

• Diversified Growth Funds: Investments are comprised of units in commingled diversified growth funds. These investments are valued

based on the net asset value (NAV) per unit as reported by the fund manager, and are classified as Level 3 due to the unobservable

inputs used to determine a fair value.

• Securities Lending Fund: Investment represents a commingled fund through our custodian's securities lending program. The U.S.

pension plan lends securities that are held within the plan to other banks and/or brokers, and receives collateral, typically cash. This

collateral is invested in a short-term fixed income securities commingled fund. The commingled fund is not listed or traded on an

exchange and is classified as Level 2. This amount invested in the fund is offset by a corresponding liability reflected in the U.S.

pension plan's net assets available for benefits.

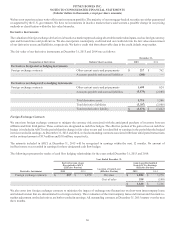

Level 3 Gains and Losses

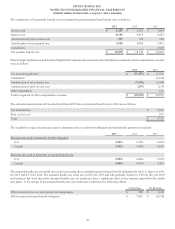

The following table summarizes the changes in the fair value of Level 3 assets for the years ended December 31, 2015 and 2014:

United States Pension Plans

Mortgage-backed

securities Private equity Real estate Total

Balance at December 31, 2013 $ 2,634 $ 87,470 $ 67,917 $ 158,021

Realized gains 12 11,174 285 11,471

Unrealized gains 59 1,886 6,140 8,085

Net purchases, sales and settlements (603)(19,284) 405 (19,482)

Balance at December 31, 2014 2,102 81,246 74,747 158,095

Realized gains 10 14,288 1,027 15,325

Unrealized gains (losses) 28 (6,844) 7,043 227

Net purchases, sales and settlements (548)(25,113)(248) (25,909)

Balance at December 31, 2015 $ 1,592 $ 63,577 $ 82,569 $ 147,738