Pitney Bowes 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Dividends and Share Repurchases

We paid dividends to our common stockholders of $150 million ($0.75 per share), $152 million ($0.75 per share) and $189 million ($0.94

per share) in 2015, 2014 and 2013, respectively. Each quarter, our Board of Directors considers our recent and projected earnings and

other capital needs and priorities in deciding whether to approve the payment, as well as the amount of a dividend. There are no material

restrictions on our ability to declare dividends.

We repurchased $132 million of our common shares during 2015 and $50 million of our common shares during 2014. At December 31,

2015, we had authorization to repurchase up to $65 million of our common shares. In February 2016, we received authorization to

repurchase an additional $150 million of outstanding stock. We expect to repurchase up to $215 million of our common stock during

2016.

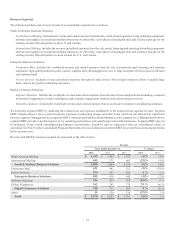

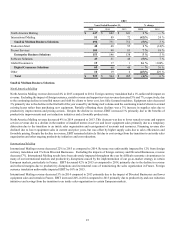

Contractual Obligations

The following table summarizes our known contractual obligations at December 31, 2015 and the effect that such obligations are expected

to have on our liquidity and cash flow in future periods:

Payments due in

Total 2016 2017-18 2019-20 After 2020

Commercial paper borrowings $90

$ 90$ —$ —$ —

Debt maturities 2,862 371 1,135 301 1,055

Interest payments on debt (1) 1,261 133 205 119 804

Preferred stock (2) 300 300—— —

Non-cancelable operating lease obligations 202 40 57 37 68

Purchase obligations (3) 203 188 15 — —

Pension plan contributions (4) 55 55—— —

Retiree medical payments (5) 166 19 37 34 76

Total $ 5,139 $ 1,196 $ 1,449 $ 491 $ 2,003

The amount and period of future payments related to our income tax uncertainties cannot be reliably estimated and are not included in

the above table. See Note 15 to the Consolidated Financial Statements for further details.

(1) Assumes all debt is held to maturity. Certain notes are redeemable, either at our option or the bondholders, at par plus accrued interest

before the scheduled maturity date.

(2) Represents outstanding Preferred Stock of one of our subsidiaries that is redeemable at our option. If we do not redeem by October

30, 2016, the dividend rate increases 50% and will increase 50% every six months thereafter.

(3) Includes unrecorded agreements to purchase goods or services that are enforceable and legally binding upon us and that specify all

significant terms, including fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the

approximate timing of the transaction. Purchase obligations exclude agreements that are cancelable without penalty.

(4) Represents the amount of contributions we anticipate making to our pension plans during 2016; however, we will assess our funding

alternatives as the year progresses.

(5) Our retiree health benefit plans are non-funded plans and cash contributions are made each year to cover medical claims costs

incurred. The amounts reported in the above table represent our estimate of future benefits payments.

Off-Balance Sheet Arrangements

At December 31, 2015, we had no off-balance sheet arrangements that have, or are reasonably likely to have, a material current or future

effect on our financial condition, results of operations or liquidity. See Note 17 to the Consolidated Financial Statements for detailed

information about our commitments and contingencies.