Pitney Bowes 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

49

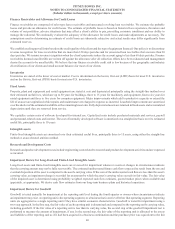

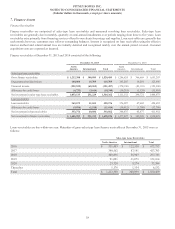

Deferred Marketing Costs

We capitalize certain costs associated with the acquisition of new customers and recognize these costs over the expected revenue stream

of eight years. Amortization of deferred marketing costs was $18 million, $23 million and $27 million in 2015, 2014 and 2013, respectively.

Deferred marketing costs included in other assets in the Consolidated Balance Sheets at December 31, 2015 and 2014 were $43 million

and $49 million, respectively. We review individual marketing programs for impairment on a quarterly basis or as circumstances warrant.

Restructuring Charges

Costs associated with restructuring actions and other exit or disposal activities include employee severance and other employee separation

costs and lease termination costs. These costs are recognized when a liability has been incurred, which is generally upon communication

to the affected employees or exit from a leased facility, and the amount to be paid is both probable and reasonably estimable. The rates

used in determining severance accruals are based on company policy, historical experience and negotiated settlements.

Derivative Instruments

In the normal course of business, we are exposed to the impact of changes in foreign currency exchange rates and interest rates. We limit

these risks by following established risk management policies and procedures, including the use of derivatives. We use derivative

instruments to limit the effects of currency exchange rate fluctuations on financial results and manage the related cost of debt. We do not

use derivatives for trading or speculative purposes.

We record our derivative instruments at fair value and the accounting for changes in fair value depends on the intended use of the derivative,

the resulting designation and the effectiveness of the instrument in offsetting the risk exposure it is designed to hedge. To qualify as a

hedge, a derivative must be highly effective in offsetting the risk designated for hedging purposes. The hedge relationship must be formally

documented at inception, detailing the particular risk management objective and strategy for the hedge. The effectiveness of the hedge

relationship is evaluated on a retrospective and prospective basis.

The use of derivative instruments exposes us to counterparty credit risk. To mitigate such risks, we enter into contracts with only those

financial institutions that meet stringent credit requirements. We regularly review our credit exposure balances as well as the

creditworthiness of our counterparties. We have not seen a material change in the creditworthiness of those banks acting as derivative

counterparties.

Income Taxes

We recognize deferred tax assets and liabilities for the future tax consequences attributable to differences between the carrying amounts

of assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using the enacted tax rates expected

to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect of a

change in tax rates on deferred tax assets and liabilities is recognized in income in the period that includes the enactment date of such

change. A valuation allowance is provided when it is more likely than not that a deferred tax asset will not be realized. In assessing

whether a valuation allowance is necessary, and the amount of such allowance, we consider all available evidence for each jurisdiction

including past operating results, estimates of future taxable income and the feasibility of ongoing tax planning strategies. As new

information becomes available that would alter our determination as to the amount of deferred tax assets that will ultimately be realized,

we adjust the valuation allowance with a corresponding impact to income tax expense in the period in which such determination is made.

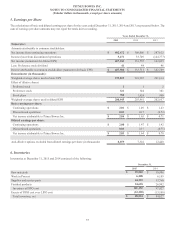

Earnings per Share

Basic earnings per share is based on the weighted-average number of common shares outstanding during the year. Diluted earnings per

share also includes the dilutive effect of stock awards, preference stock, preferred stock and stock purchase plans.

Translation of Non-U.S. Currency Amounts

In general, the functional currency of our foreign operations is the local currency. Assets and liabilities of subsidiaries operating outside

the U.S. are translated at rates in effect at the end of the period and revenue and expenses are translated at average monthly rates during

the period. Net deferred translation gains and losses are included as a component of accumulated other comprehensive income.

Loss Contingencies

In the ordinary course of business, we are routinely defendants in, or party to, a number of pending and threatened legal actions. On a

quarterly basis, we review the status of each significant matter and assess the potential financial exposure. If the potential loss from any

claim or legal action is considered probable and can be reasonably estimated, we establish a liability for the estimated loss. The assessment

of the ultimate outcome of each claim or legal action and the determination of the potential financial exposure requires significant