Pitney Bowes 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

48

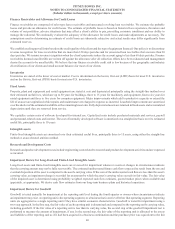

arrangements are bundled with maintenance and support services and we establish VSOE of fair value using a bell-shaped curve analysis

for maintenance and support services renewal rates. If we cannot obtain VSOE for any undelivered software element, revenue is deferred

until all deliverables have been delivered or until VSOE can be determined for any remaining undelivered software elements.

We recognize revenue from standalone software licenses upon delivery of the product when persuasive evidence of an arrangement exists,

delivery has occurred, the fee is fixed and determinable and collectability is probable. For software licenses that are included in a lease

contract, we recognize revenue upon shipment of the software unless the lease contract specifies that the license expires at the end of the

lease or the price of the software is deemed not fixed or determinable based on historical evidence of similar software leases. In these

instances, revenue is recognized on a straight-line basis over the term of the lease contract. We recognize revenue from software requiring

integration services at the point of customer acceptance. We recognize revenue related to off-the-shelf perpetual software licenses generally

upon shipment.

Rentals Revenue

We rent equipment, primarily postage meters and mailing equipment, under short-term rental agreements. Rentals revenue includes

revenue from the subscription for digital meter services. We may invoice in advance for postage meter rentals according to the terms of

the agreement. We initially defer these advanced billings and recognize rentals revenue on a straight-line basis over the invoice period.

Revenues generated from financing clients for the continued use of equipment subsequent to the expiration of the original lease are

recognized as rentals revenue.

We capitalize certain initial direct costs incurred in consummating a rental transaction and recognize these costs over the expected term

of the agreement. Amortization of initial direct costs was $8 million, $10 million and $11 million in 2015, 2014 and 2013, respectively.

Initial direct costs included in rental property and equipment, net in the Consolidated Balance Sheets at December 31, 2015 and 2014

were $20 million and $22 million, respectively.

Financing Revenue

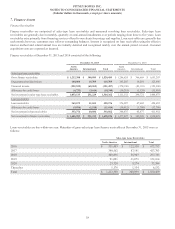

We provide lease financing for our products primarily through sales-type leases. We also provide revolving lines of credit to our clients

for the purchase of postage and supplies. We believe that our sales-type lease portfolio contains only normal collection risk. Accordingly,

we record the fair value of equipment as sales revenue, the cost of equipment as cost of sales and the minimum lease payments plus the

estimated residual value as finance receivables. The difference between the finance receivable and the equipment fair value is recorded

as unearned income and is amortized as income over the lease term using the interest method.

Equipment residual values are determined at inception of the lease using estimates of equipment fair value at the end of the lease term.

Estimates of future equipment fair value are based primarily on historical experience. We also consider forecasted supply and demand

for various products, product retirement and launch plans, regulatory changes, remanufacturing strategies, used equipment markets, if

any, competition and technological changes. We evaluate residual values on an annual basis or sooner if circumstances warrant. Declines

in estimated residual values considered "other-than-temporary" are recognized immediately. Estimated increases in future residual values

are not recognized until the equipment is remarketed.

Support Services Revenue

We provide support services for our equipment primarily through maintenance contracts. Revenue related to these agreements is recognized

on a straight-line basis over the term of the agreement.

Business Services Revenue

Business services revenue includes revenue from presort mail services, global ecommerce solutions and shipping solutions. Prior to our

divestiture of Imagitas in May 2015, business services revenue also included revenues from direct marketing services. Revenue for these

services were recognized as the services were provided.

We also evaluate whether it is appropriate to record revenue on a gross basis when we are acting as a principal in the transaction or net

of costs when we are acting as an agent between the client and the vendor. We consider several factors in determining whether we are

acting as principal or agent such as whether we are the primary obligor to the client, have control over the pricing and have credit risk.

Shipping and Handling

Shipping and handling costs are recognized as incurred and recorded in cost of revenues.