Pitney Bowes 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

61

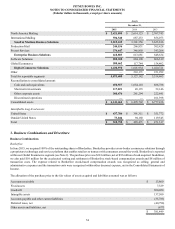

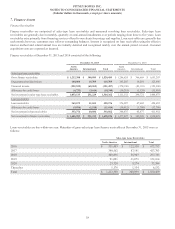

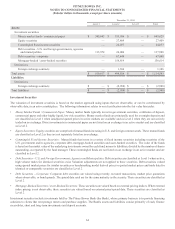

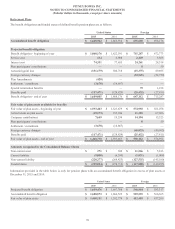

8. Fixed Assets

Fixed assets at December 31, 2015 and 2014 consisted of the following:

December 31,

2015 2014

Land $ 9,908 $ 9,908

Capitalized Software 87,102 44,152

Buildings 218,261 213,196

Machinery and equipment 897,532 879,222

1,212,803 1,146,478

Accumulated depreciation (882,715)(861,387)

Property, plant and equipment, net $ 330,088 $ 285,091

Rental property and equipment $ 407,495 $ 462,244

Accumulated depreciation (226,833)(261,864)

Rental property and equipment, net $ 180,662 $ 200,380

Depreciation expense was $136 million, $165 million and $158 million for the years ended December 31, 2015, 2014 and 2013,

respectively.

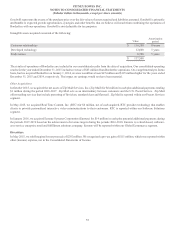

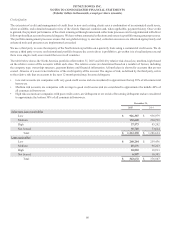

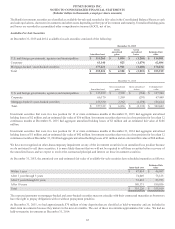

9. Intangible Assets and Goodwill

Intangible assets

Intangible assets at December 31, 2015 and 2014 consisted of the following:

December 31, 2015 December 31, 2014

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Customer relationships $ 437,459 $ (272,353) $ 165,106 $ 337,438 $ (263,121) $ 74,317

Supplier relationships ———

29,000 (27,913) 1,087

Software & technology 149,591 (135,198) 14,393 160,825 (154,610) 6,215

Trademarks & other 35,314 (27,435) 7,879 33,079 (32,525) 554

Total intangible assets, net $ 622,364 $ (434,986) $ 187,378 $ 560,342 $ (478,169) $ 82,173

Amortization expense for intangible assets was $37 million, $34 million and $37 million for the years ended December 31, 2015, 2014

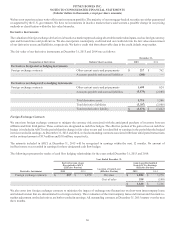

and 2013, respectively. The future amortization expense for intangible assets at December 31, 2015 was as follows:

Year ended December 31,

2016 $ 38,165

2017 27,400

2018 24,800

2019 21,741

2020 17,025

Thereafter 58,247

Total $ 187,378

Actual amortization expense may differ from the amounts above due to, among other things, fluctuations in foreign currency exchange

rates, acquisitions, divestitures and impairment charges.