Pitney Bowes 2015 Annual Report Download - page 67

Download and view the complete annual report

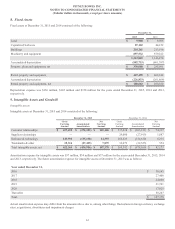

Please find page 67 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

51

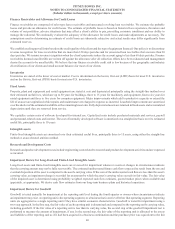

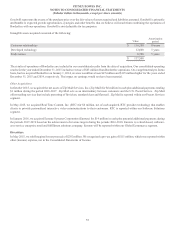

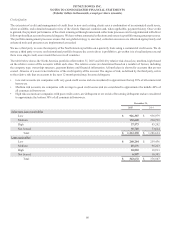

for fiscal periods beginning after December 15, 2015. We will adopt this standard in the first quarter of 2016 and the adoption of this

standard will not have an impact on our consolidated financial statements or disclosures.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers. The standard requires companies to recognize

revenue for the transfer of goods and services to customers in amounts that reflect the consideration the company expects to receive in

exchange for those goods and services. The standard will also result in enhanced disclosures about revenue. In July 2015, the FASB

approved a one-year deferral of the effective date. This standard is now effective for fiscal periods beginning after December 15, 2017.

The standard can be adopted either retrospectively or as a cumulative-effect adjustment. Companies are permitted to adopt the standard

as early as the original public entity effective date (fiscal periods beginning after December 15, 2016). Early adoption prior to that date

is prohibited. We are currently assessing the impact this standard will have on our consolidated financial statements and disclosures.

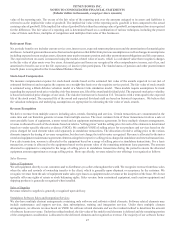

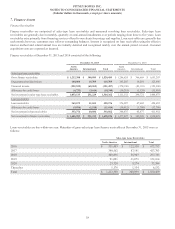

2. Segment Information

The principal products and services of each of our reportable segments are as follows:

Small & Medium Business Solutions:

North America Mailing: Includes the revenue and related expenses from the sale, rental, financing and servicing of mailing equipment,

software and supplies for small and medium businesses to efficiently create physical and digital mail and evidence postage for the

sending of mail, flats and parcels in the U.S. and Canada.

International Mailing: Includes the revenue and related expenses from the sale, rental, financing and servicing of mailing equipment,

software and supplies for small and medium businesses to efficiently create physical and digital mail and evidence postage for the

sending of mail, flats and parcels in areas outside the U.S. and Canada.

Enterprise Business Solutions:

Production Mail: Includes the worldwide revenue and related expenses from the sale of production mail inserting and sortation

equipment, high-speed production print systems, supplies and related support services to large enterprise clients to process inbound

and outbound mail.

Presort Services: Includes revenue and related expenses from presort mail services for our large enterprise clients to qualify large

mail volumes for postal worksharing discounts.

Digital Commerce Solutions:

Software Solutions: Includes the worldwide revenue and related expenses from the sale of non-equipment-based mailing, customer

information management, location intelligence and customer engagement solutions and related support services.

Global Ecommerce: Includes the worldwide revenue and related expenses from cross-border ecommerce and shipping solutions.

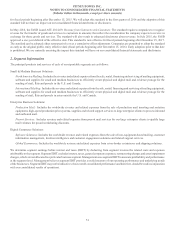

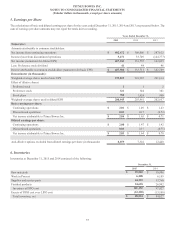

We determine segment earnings before interest and taxes (EBIT) by deducting from segment revenue the related costs and expenses

attributable to the segment. Segment EBIT excludes interest, taxes, general corporate expenses, restructuring charges and asset impairment

charges, which are not allocated to a particular business segment. Management uses segment EBIT to measure profitability and performance

at the segment level. Management believes segment EBIT provides a useful measure of our operating performance and underlying trends

of the businesses. Segment EBIT may not be indicative of our overall consolidated performance and therefore, should be read in conjunction

with our consolidated results of operations.