Pitney Bowes 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Share Repurchases

We may periodically repurchase shares of our common stock to manage the dilution created by shares issued under employee stock plans

and for other purposes. For the full year 2015, we repurchased 6,655,196 shares of our common stock at an average share price of $20.35.

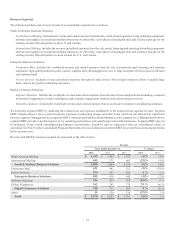

The following table provides information about our purchases of our common stock during the three months ended December 31, 2015:

Number of

shares purchased

Average price

paid per share

Number of

shares

purchased

as part of a

publicly

announced plan

Approximate

dollar value of

shares that may

be purchased

under the plan (in

thousands) (1)

Beginning balance

$100,000

October 2015 — — — $100,000

November 2015 — — — $100,000

December 2015 1,744,600 $ 20.31 1,744,600 $64,567

1,744,600 $ 20.31 1,744,600

(1) In September 2015, we received authorization from our Board of Directors to repurchase $100 million of our common stock. The

plan does not have an expiration date.

In February 2016, we received authorization from our Board of Directors to repurchase an additional $150 million of outstanding stock.

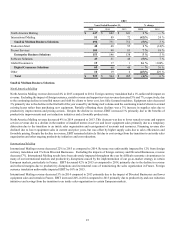

Stock Performance Graph

Our peer group is comprised of: Alliance Data Systems Corporation, Diebold, Incorporated, DST Systems Inc., EchoStar Corp., Fidelity

National Information Services, Inc., Fiserv, Inc., Harris Corporation, Iron Mountain Inc., Lexmark International Inc., NCR Corp., Pitney

Bowes Inc., R.R. Donnelley & Sons Company, Rockwell Automation Inc., Unisys Corporation, The Western Union Company and Xerox

Corporation.

The accompanying graph shows the annual changes for the five-year period based on the assumption that $100 was invested in Pitney

Bowes, the Standard and Poor's (S&P) 500 Composite Index and our peer group, and that all dividends were reinvested. On a total return

basis, $100 invested in Pitney Bowes, the S&P 500 Composite Index and our peer group on December 31, 2010 would have been worth

$115, $181, $173, respectively, on December 31, 2015.

All information is based upon data independently provided to us by Standard & Poor's Corporation and is derived from their official total

return calculation. Total return for the S&P 500 Composite Index and each peer group is based on market capitalization, weighted for

each year. The stock price performance is not necessarily indicative of future stock price performance.