Pitney Bowes 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

88

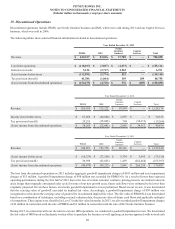

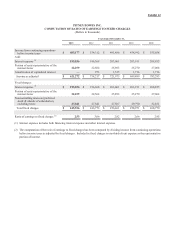

19. Discontinued Operations

Discontinued operations include PBMS, our Nordic furniture business and IMS, which were sold during 2013 and our Capital Services

business, which was sold in 2006.

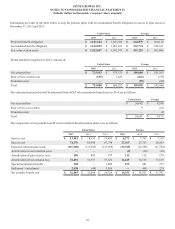

The following tables show selected financial information included in discontinued operations:

Year Ended December 31, 2013

PBMS IMS

Nordic

furniture

business

Capital

Services Total

Revenue $ 639,237 $ 23,036 $ 37,785 $ — $ 700,058

Loss from operations $(118,017)$ (3,057)$ (4,037) $ — $ (125,111)

Gain (loss) on sale 5,126 (2,717) 4,562 — 6,971

(Loss) income before taxes (112,891)(5,774) 525 — (118,140)

Tax provision (benefit) 41,384 (1,064) 149 289 40,758

(Loss) income from discontinued operations $(154,275)$ (4,710) $ 376 $ (289) $ (158,898)

Year Ended December 31, 2012

PBMS IMS

Nordic

furniture

business

Capital

Services Total

Revenue $ 920,958 $ 135,222 $ 67,994 $ — $ 1,124,174

Income (loss) before taxes $ 67,458 $ (40,084) $ 2,839 $ — $ 30,213

Tax provision (benefit) 29,255 (15,003) 794 (34,312) (19,266)

(Loss) income from discontinued operations $ 38,203 $ (25,081) $ 2,045 $ 34,312 $ 49,479

Year Ended December 31, 2011

PBMS IMS

Nordic

furniture

business

Capital

Services Total

Revenue $ 948,891 $ 155,378 $ 48,341 $ — $ 1,152,610

before taxes $ (10,279)$ (72,260) $ 5,334 $ 3,695 $ (73,510)

Tax provision (benefit) 30,599 (23,025) 1,493 (262,464) (253,397)

(Loss) income from discontinued operations $ (40,878)$ (49,235) $ 3,841 $ 266,159 $ 179,887

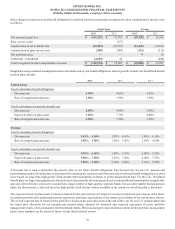

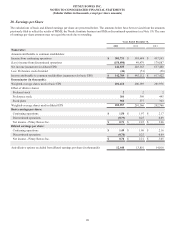

The loss from discontinued operations in 2013 includes aggregate goodwill impairment charges of $101 million and asset impairment

charges of $15 million. A goodwill impairment charge of $98 million was recorded for PBMS NA. As a result of lower than expected

operating performance during the first half of 2013 due to the loss of certain customer contracts, pricing pressure on contract renewals

and a longer than originally anticipated sales cycle for some of our new growth areas, future cash flows were estimated to be lower than

originally projected. Given these factors, an interim goodwill impairment test was performed. Based on our review, it was determined

that the carrying value of goodwill exceeded its implied fair value. Accordingly, a goodwill impairment charge of $98 million was

recognized to write-down the carrying value of goodwill to its estimated implied fair value. The fair value of PBMS NA was determined

based on a combination of techniques, including external valuation data, the present value of future cash flows and applicable multiples

of competitors. These inputs were classified as Level 3 in the fair value hierarchy. In 2013, we also recorded goodwill impairment charges

of $2 million in connection with the sale of PBMSi and $1 million in connection with the sale of the Nordic furniture business.

During 2012, in connection with our decision to exit our IMS operations, we conducted a goodwill impairment review. We determined

the fair value of IMS based on third-party written offers to purchase the business as well applying an income approach with revised cash

(Loss) income