Pitney Bowes 2013 Annual Report Download - page 100

Download and view the complete annual report

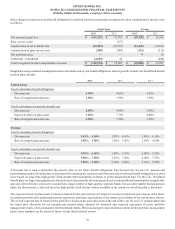

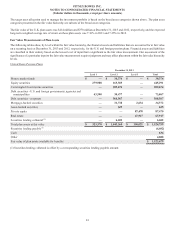

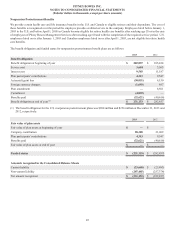

Please find page 100 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

89

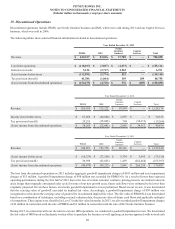

flow projections. The inputs used to determine the fair value of IMS were classified as Level 3 in the fair value hierarchy. Based on the

results of our impairment test, a goodwill impairment charge of $18 million and asset impairment charges of $17 million were recorded

to write-down the carrying value of goodwill, intangible assets and other assets to their respective implied fair values.

Income from discontinued operations in 2011 includes aggregate goodwill impairment charges of $130 million and asset impairment

charges of $17 million. Due to the under-performance of IMS, we performed a goodwill impairment review. We determined the fair value

of IMS using a combination of techniques including the present value of future cash flows, multiples of competitors and multiples from

sales of like businesses, and determined that the IMS reporting unit was impaired. The inputs used to determine the fair value of IMS

were classified as Level 3 in the fair value hierarchy. Based on the results of our impairment test, we recorded a goodwill impairment

charge of $46 million and an intangible asset impairment charge of $12 million to write-down the carrying value of goodwill and intangible

assets to their respective implied fair values.

Also in 2011, based on the results of our annual goodwill impairment review, management determined that PBMSi was impaired. The

fair value of PBMSi was determined using a combination of techniques including the present value of future cash flows, derived from

our long-term plans and historical experience, multiples of competitors and multiples from sales of like businesses. The inputs used to

determine the fair value were classified as Level 3 in the fair value hierarchy. Based on the results of our impairment test, we recorded

a goodwill impairment charge of $84 million and intangible asset impairment charge of $5 million to write-down the carrying value of

goodwill and intangible assets to their respective estimated fair values.

The amounts recognized for Capital Services in 2013, 2012 and 2011 relate primarily to tax benefits from the resolution of tax examinations.