Pitney Bowes 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

45

is determined using probability weighted expected cash flow estimates, quoted market prices when available and appraisals, as appropriate.

We derive cash flow estimates from our long-term business plans and historical experience.

Impairment Review for Goodwill and Intangible Assets

Goodwill is tested annually for impairment during the fourth quarter or sooner when circumstances indicate an impairment may exist, at

the reporting unit level. A reporting unit is the operating segment, or a business that is one level below that operating segment. Reporting

units are aggregated as a single reporting unit if they have similar economic characteristics. Goodwill is tested for impairment using a

two-step approach. In the first step, the fair value of each reporting unit is determined and compared to the reporting unit's carrying value,

including goodwill. If the fair value of a reporting unit is less than its carrying value, the second step of the goodwill impairment test is

performed to measure the amount of impairment, if any. In the second step, the fair value of the reporting unit is allocated to the assets

and liabilities of the reporting unit as if it had been acquired in a business combination and the purchase price was equivalent to the fair

value of the reporting unit. The excess of the fair value of the reporting unit over the amounts assigned to its assets and liabilities is

referred to as the implied fair value of goodwill. The implied fair value of the reporting unit's goodwill is then compared to the actual

carrying value of goodwill. If the implied fair value of goodwill is less than the carrying value of goodwill, an impairment loss is recognized

for the difference. The fair value of a reporting unit is determined based on a combination of various techniques, including the present

value of future cash flows, multiples of competitors and multiples from sales of like businesses.

Intangible assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not

be fully recoverable. The related estimated future undiscounted cash flows expected to result from the use of the asset and its eventual

disposition is compared to the carrying amount. If the sum of the expected cash flows is less than the carrying amount, an impairment

charge is recorded. The impairment charge is measured as the amount by which the carrying amount exceeds the fair value of the asset.

The fair value of the asset is determined using probability weighted expected cash flow estimates, quoted market prices when available

and appraisals, as appropriate.

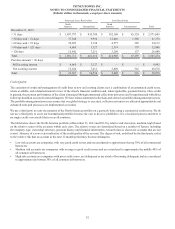

Retirement Plans

Actual pension plan results that differ from our assumptions and estimates are accumulated and amortized over the life expectancy of

inactive plan participants and affect future pension cost. Net periodic pension cost includes current service cost, interest cost and return

on plan assets. Net pension cost is also based on a market-related valuation of plan assets where differences between the actual and

expected return on plan assets are amortized to pension cost over a five-year period. We recognize the funded status of pension and other

postretirement benefit plans in the Consolidated Balance Sheets. Gains and losses, prior service costs and credits and any remaining

transition amounts that have not yet been recognized in net periodic benefit cost are recognized in accumulated other comprehensive

income, net of tax, until they are amortized as a component of net periodic benefit cost.

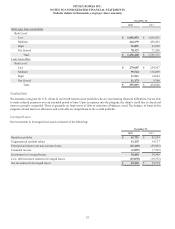

Stock-based Compensation

We measure compensation expense for stock-based awards based on the estimated fair value of the awards expected to vest (net of

estimated forfeitures) and recognize the expense on a straight-line basis over the employee requisite service period. We estimate the fair

value of stock awards using a Black-Scholes valuation model or a Monte Carlo simulation model for those awards that contain a market

condition. We believe that the valuation techniques and the approach utilized to develop the underlying assumptions are appropriate in

estimating the fair value of our stock awards. Estimates of fair value are not intended to predict actual future events or the value ultimately

realized by employees and subsequent events are not indicative of the reasonableness of the original estimates of fair value.

Revenue Recognition

We derive revenue from multiple sources including sales, rentals, financing and services. Certain transactions are consummated at the

same time and generate revenue from multiple sources. The most common form of these transactions involves the sale or non-cancelable

lease of equipment, a meter rental and an equipment maintenance agreement. In these multiple element arrangements, revenue is allocated

to each of the elements based on relative “selling prices” and the selling price for each of the elements is determined based on vendor

specific objective evidence. We establish vendor specific objective evidence of selling prices for our products and services based on the

prices charged for each element when sold separately in standalone transactions. The allocation of relative selling price to the various

elements impacts the timing of revenue recognition, but does not change the total revenue recognized. Revenue is allocated to the meter

rental and equipment maintenance agreement elements using their respective selling prices charged in standalone and renewal transactions.

For a sale transaction, revenue is allocated to the equipment based on a range of selling prices in standalone transactions. For a lease

transaction, revenue is allocated to the equipment based on the present value of the remaining minimum lease payments. The amount

allocated to equipment is compared to the range of selling prices in standalone transactions during the period to ensure the allocated

equipment amount approximates average selling prices. More specifically, revenue related to our offerings is recognized as follows: