Pitney Bowes 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

72

15. Commitments and Contingencies

In the ordinary course of business, we are routinely defendants in, or party to, a number of pending and threatened legal actions. These

may involve litigation by or against us relating to, among other things, contractual rights under vendor, insurance or other contracts;

intellectual property or patent rights; equipment, service, payment or other disputes with clients; or disputes with employees. Some of

these actions may be brought as a purported class action on behalf of a purported class of employees, clients or others.

In December 2013, we received a Civil Investigative Demand (CID) from the Department of Justice (DOJ) pursuant to the False Claims

Act requesting documents and information relating to compliance with certain postal regulatory requirements in our Presort Services

business. We had previously provided information to the DOJ in response to letter requests and continue to provide information in response

to the CID and other requests from the DOJ. Given the current stage of this inquiry, we cannot provide an estimate of any possible losses

or range of loss and we cannot yet predict the ultimate outcome of this matter or its impact, if any, on our business, financial condition

or results of operations.

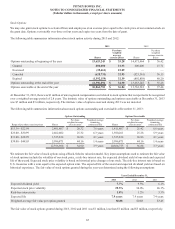

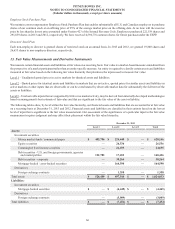

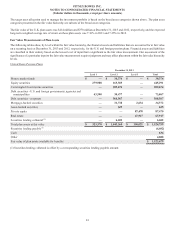

16. Leases

We lease office facilities, sales and service offices, equipment and other properties under operating lease agreements extending from

three to eight years. Certain leases require us to pay property taxes, insurance and routine maintenance and include renewal options and

escalation clauses. Rental expense was $67 million, $68 million and $78 million in 2013, 2012 and 2011, respectively. Future minimum

lease payments under non-cancelable operating leases at December 31, 2013 were as follows:

Years ending December 31,

2014 $ 55,908

2015 43,089

2016 30,246

2017 21,234

2018 15,660

Thereafter 35,115

Total minimum lease payments $ 201,252