Pitney Bowes 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

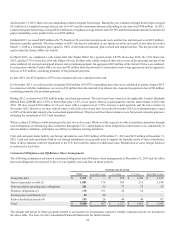

Net income from continuing operations and earnings per diluted share for 2013 were $302 million and $1.49, respectively, compared to

$396 million and $1.96, respectively, in 2012. The decrease in 2013 was primarily due to higher restructuring charges and losses related

to the early redemption of debt, as well declines in some of our high margin recurring revenue streams.

For the year, we generated cash flow from operations of $625 million, received $390 million from the sale of businesses and issued $412

million of long-term debt. We used these proceeds to redeem long-term debt of $1,079 million, pay dividends of $207 million and fund

capital investments of $138 million. At December 31, 2013, cash and cash equivalents and short-term investments were $939 million.

Outlook

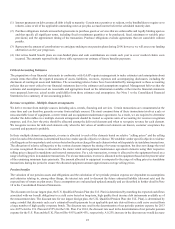

We continue to focus on three critical areas: stabilizing the mailing business, achieving operational excellence and driving growth in our

Digital Commerce Solutions segment.

Within the Small & Medium Business Solutions group, we expect revenue and profitability growth to continue to be challenged by the

decline in physical mail volumes. However, we anticipate revenue and profitability trends will show continued improvement in 2014,

due in part to the implementation of a new "go-to-market" strategy in North America that provides our clients broader access to products

and services through online and direct sales channels, broader solutions to serve the rapid growth in parcel shipments and a more agile

workforce. In addition, postal agencies in North America recently announced discounts for postage meter users, which are anticipated to

enhance the value proposition of meter usage in North America and further stabilize recurring stream revenues. Within our international

mailing markets, we are continuing to expand sales of our Connect+TM mailing systems. In addition, the stabilization in the international

meter population which began in 2013 is expected to continue in 2014, resulting in the continued improvement in recurring stream revenue

trends.

Within the Enterprise Business Solutions group, we expect demand for our production mail inserter and sortation equipment and high-

speed production print equipment to continue; however, we do not anticipate similar growth rates in 2014 due to significant sales of

production printers during 2013. Within our Presort Services segment, we expect increasing revenue due to workshare improvements

and new sales opportunities.

In our Digital Commerce Solutions segment, we anticipate growth to be driven by continued demand for our location intelligence,

customer data and engagement solutions and increasing volumes associated with our e-commerce cross-border parcel management

solutions.

We will begin work on the initial phases of a new global ERP system in 2014. The implementation of the ERP system will occur in stages

and is anticipated to be a multi-year process. We will make a significant investment and incur incremental expenses over the course of

the implementation of this system. In 2014, we anticipate these expenses could approximate $0.10 per diluted share. The ERP system is

expected to provide operating cost savings through the elimination of redundant systems and strategic efficiencies through the use of a

standardized, integrated system.

Our growth initiatives continue to focus on leveraging our expertise in physical communications with our expanding capabilities in digital

and hybrid communications and developing products, software, services and solutions that help our clients grow their businesses by more

effectively communicating with their customers.