Pitney Bowes 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

56

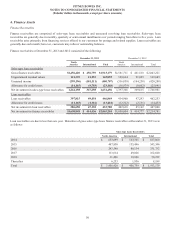

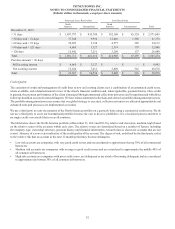

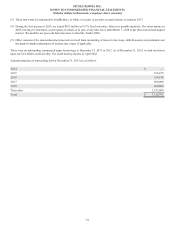

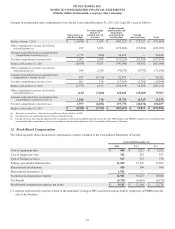

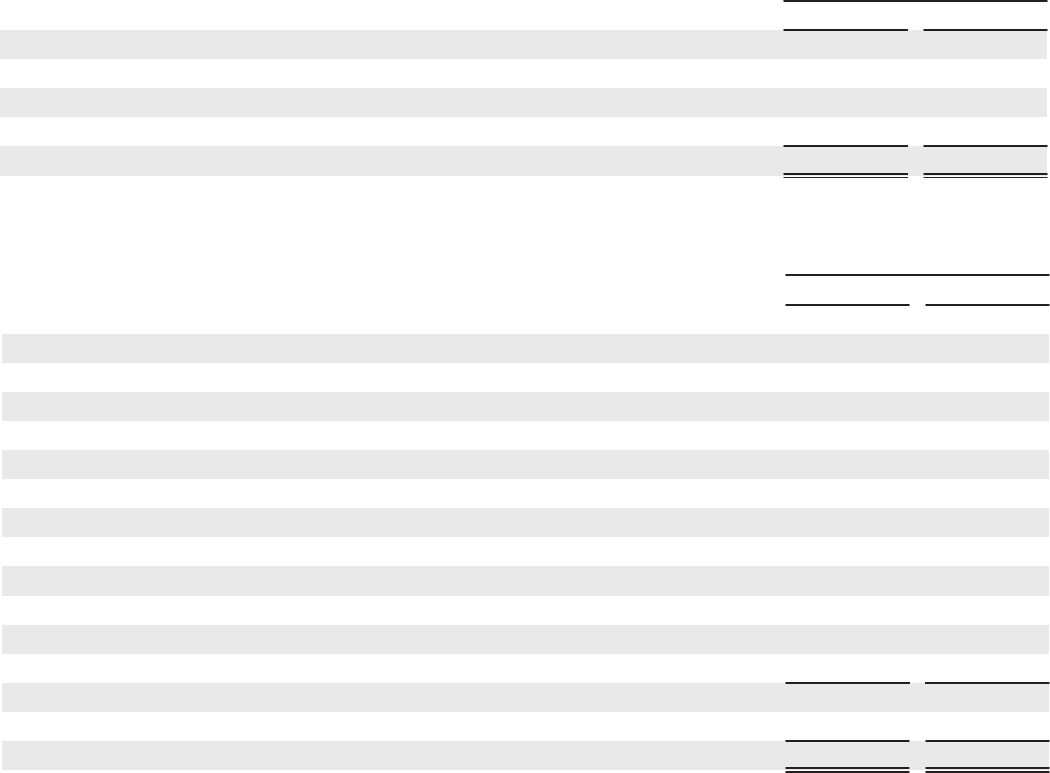

6. Accounts Payable and Accrued Liabilities

Accounts payable and accrued liabilities consisted of the following:

December 31,

2013 2012

Accounts payable $ 270,067 $ 362,938

Customer deposits 672,440 698,770

Employee related liabilities 332,072 356,188

Miscellaneous other 370,003 391,330

Accounts payable and accrued liabilities $ 1,644,582 $ 1,809,226

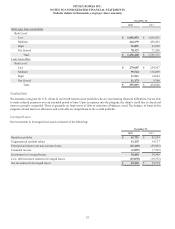

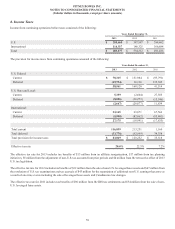

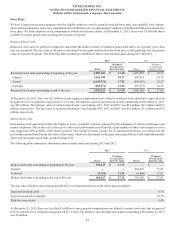

7. Debt

December 31,

2013 2012

Term loans $ 230,000 $ 230,000

3.875% notes due 2013 —375,000

4.875% notes due 2014 (1) —450,000

5.00% notes due 2015 (1) 274,879 400,000

4.75% notes due 2016 (1) 370,914 500,000

5.75% notes due 2017 500,000 500,000

5.60% notes due Mar 2018 250,000 250,000

4.75% notes due May 2018 350,000 350,000

6.25% notes due 2019 300,000 300,000

5.25% notes due 2022 (2) 110,000 110,000

5.25% notes due 2037 (3) 500,000 500,000

6.70% notes due 2043 (4) 425,000 —

Other (5) 35,502 52,375

Total debt 3,346,295 4,017,375

Current portion long-term debt —375,000

Long-term debt $ 3,346,295 $ 3,642,375

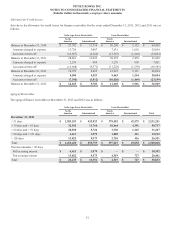

Term loans bear interest at the applicable London Interbank Offered Rate (LIBOR) plus 2.25% or Prime Rate plus 1.25%, at our option.

Interest is payable and resets quarterly and the loans mature in 2015 and 2016.

(1) During the first quarter 2013, we completed a cash tender offer (the Tender Offer) for a portion of our 4.875% Notes due 2014 (2014

Notes), our 5.0% Notes due 2015, and our 4.75% Notes due 2016 (the Subject Notes). Holders who validly tendered their notes

received the principal amount of the notes tendered, all accrued and unpaid interest and a premium amount. An aggregate $405

million of the Subject Notes were tendered. Subsequently, in the fourth quarter of 2013, we redeemed the remaining outstanding

2014 Notes that were scheduled to mature August 2014 through the exercise of a make-whole provision. In connection with the

Tender Offer and the early redemption of the 2014 Notes, we recognized an aggregate net loss of $33 million.

At December 31, 2012, we had interest rate swap agreements with an aggregate notional value of $450 million that effectively

converted the fixed rate interest payments on the 2014 Notes into variable interest rates. In connection with the Tender Offer, we

unwound a portion of these interest rate swap agreements, and in connection with redemption of the remaining outstanding notes in

the fourth quarter of 2013, we unwound the remaining interest rate swap agreements. At December 31, 2013, we had no interest rate

swaps outstanding.

(2) These notes may be redeemed, at our option, in whole or in part, at any time on or after November 27, 2015 at par plus accrued

interest.