Pitney Bowes 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

Forward-Looking Statements

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contain statements that are forward-

looking. We want to caution readers that any forward-looking statements within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934 in this Form 10-K may change based on various factors. These forward-looking

statements are based on current expectations and assumptions that are subject to risks and uncertainties and actual results could differ

materially. Words such as "estimate", "target", "project", "plan", "believe", "expect", "anticipate", "intend", and similar expressions may

identify such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise. Factors which could cause future financial performance to differ

materially from the expectations as expressed in any forward-looking statement made by or on our behalf include, without limitation:

• declining physical mail volumes

• mailers’ utilization of alternative means of communication or competitors’ products

• access to capital at a reasonable cost to continue to fund various discretionary priorities, including business investments,

acquisitions and dividend payments

• timely development and acceptance of new products and services

• successful entry into new markets

• success in gaining product approval in new markets where regulatory approval is required

• changes in postal or banking regulations

• interrupted use of key information systems

• our ability to successfully implement a new ERP system and fully realize the related savings and efficiencies

• third-party suppliers’ ability to provide product components, assemblies or inventories

• our success at managing the relationships with our outsource providers, including the costs of outsourcing functions and operations

not central to our business

• changes in privacy laws

• intellectual property infringement claims

• regulatory approvals and satisfaction of other conditions to consummate and integrate any acquisitions

• negative developments in economic conditions, including adverse impacts on customer demand

• our success at managing customer credit risk

• significant changes in pension, health care and retiree medical costs

• changes in interest rates, foreign currency fluctuations or credit ratings

• income tax adjustments or other regulatory levies for prior audit years and changes in tax laws, rulings or regulations

• impact on mail volume resulting from concerns over the use of the mail for transmitting harmful biological agents

• changes in international or national political conditions, including any terrorist attacks

• acts of nature

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our

consolidated financial statements contained in this report. All table amounts are presented in millions of dollars, unless otherwise stated.

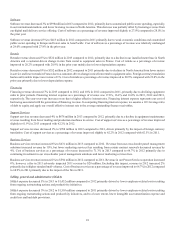

Overview

During the year, we sold our global Management Services business (PBMS), Nordic furniture business and International Mail Services

business (IMS). Further, we made certain organizational changes and realigned our business units and segment reporting to reflect the

clients we serve, the solutions we offer, and how we manage, review, analyze and measure our operations. Our historical results have

been recast to present the operating results of divested businesses as discontinued operations and our segment results have been recast

to conform to our new segment reporting.

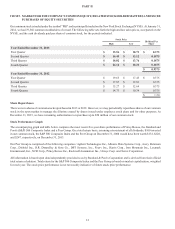

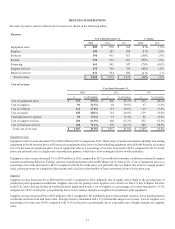

Revenue for 2013 decreased 1% to $3,869 million compared to $3,915 million in 2012 as growth in equipment sales, supplies sales and

business services were offset by declines in rentals and financing revenue, software licensing revenue and support services. Rentals and

financing revenue decreased 5% and 7%, respectively, due to a decline in the number of installed meters worldwide and lower equipment

sales in prior periods. Support services revenue decreased 4% due to fewer mailing machines in service and software revenue declined

3% due to constrained public sector spending and lower North America licensing revenue. Equipment sales grew 2% driven by higher

sales of production printers globally and sorting equipment in North America. Supplies sales increased 2% primarily due to the growing

base of production print equipment installations and stabilization of supplies sales for our postage meter business. Business services

revenue increased 6% primarily from increased demand and volumes from our e-commerce cross-border parcel management solutions.