Pitney Bowes 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

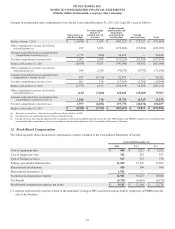

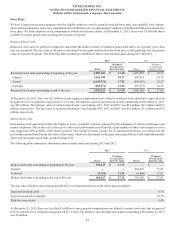

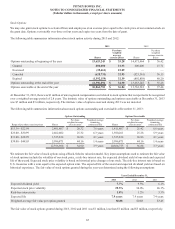

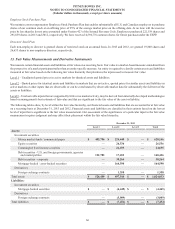

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

57

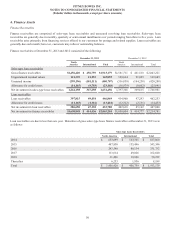

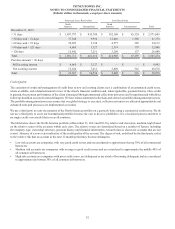

(3) These notes may be redeemed by bondholders, in whole or in part, at par plus accrued interest, in January 2017.

(4) During the first quarter of 2013, we issued $425 million of 6.7% fixed rate notes. Interest is payable quarterly. The notes mature in

2043, but may be redeemed, at our option, in whole or in part, at any time on or after March 7, 2018 at par plus accrued and unpaid

interest. We used the net proceeds from the notes to fund the Tender Offer.

(5) Other consists of the unamortized net proceeds received from unwinding of interest rate swaps, debt discounts and premiums and

the mark-to-market adjustment of interest rate swaps, if applicable.

There were no outstanding commercial paper borrowings at December 31, 2013 or 2012. As of December 31, 2013, we had not drawn

upon our $1.0 billion credit facility. The credit facility expires in April 2016.

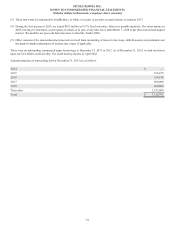

Annual maturities of outstanding debt at December 31, 2013 are as follows:

2014 $—

2015 324,879

2016 550,914

2017 500,000

2018 600,000

Thereafter 1,335,000

Total $ 3,310,793