Pitney Bowes 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

77

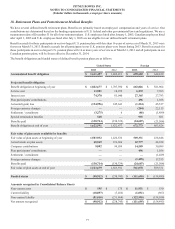

18. Retirement Plans and Postretirement Medical Benefits

We have several defined benefit retirement plans. Benefits are primarily based on employees' compensation and years of service. Our

contributions are determined based on the funding requirements of U.S. federal and other governmental laws and regulations. We use a

measurement date of December 31 for all of our retirement plans. U.S. employees hired after January 1, 2005, Canadian employees hired

after April 1, 2005 and U.K. employees hired after July 1, 2005 are not eligible for our defined benefit retirement plans.

Benefit accruals for those participants in our two largest U.S. pension plans with less than 16 years of service as of March 31, 2013 were

frozen on March 31, 2013. Benefit accruals for all participants in our U.K. pension plans were frozen during 2013. Benefit accruals for

those participants in our two largest U.S. pension plans with 16 or more years of service as of March 31, 2013 and all participants in our

Canadian pension plans, will be frozen effective December 31, 2014.

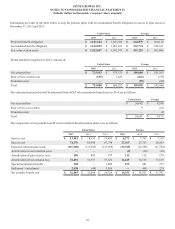

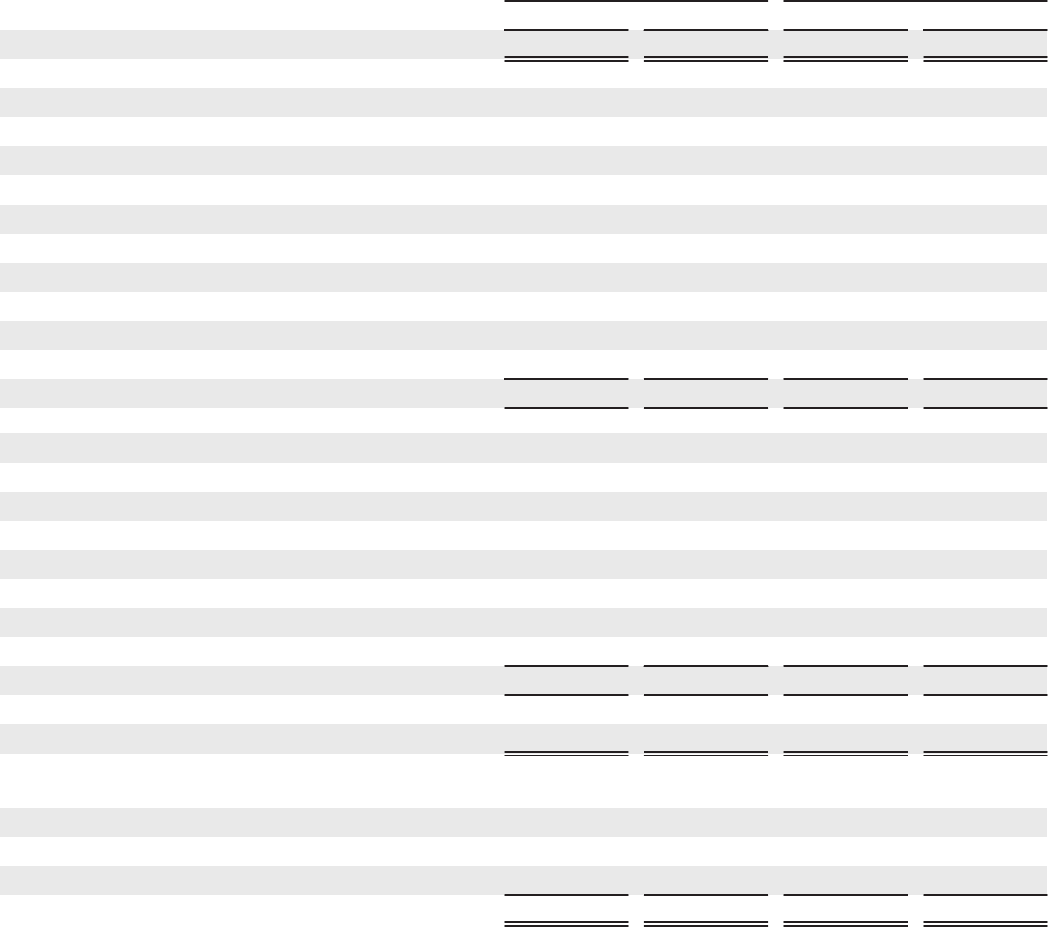

The benefit obligations and funded status of defined benefit pension plans are as follows:

United States Foreign

2013 2012 2013 2012

Accumulated benefit obligation $ 1,611,457 $ 1,802,811 $ 659,602 $ 648,439

Projected benefit obligation

Benefit obligation at beginning of year $ 1,822,677 $ 1,707,390 $ 663,826 $ 581,904

Service cost 13,981 18,939 6,272 7,763

Interest cost 74,370 81,040 27,365 27,793

Plan participants' contributions ——496 1,106

Actuarial (gain) loss (154,996)145,641 (1,224)45,537

Foreign currency changes ——(204)22,115

Settlement / curtailment (3,275)6(86)(1,489)

Special termination benefits 548 —935 601

Benefits paid (130,714)(130,339)(24,607)(21,504)

Benefit obligation at end of year 1,622,591 1,822,677 672,773 663,826

Fair value of plan assets available for benefits

Fair value of plan assets at beginning of year 1,583,932 1,426,536 509,331 438,848

Actual return on plan assets 60,569 193,696 62,777 44,928

Company contributions 9,892 94,039 14,509 30,089

Plan participants' contributions ——496 1,106

Settlement / curtailment ———(1,489)

Foreign currency changes ——(1,428)17,353

Benefits paid (130,714)(130,339)(24,607)(21,504)

Fair value of plan assets at end of year 1,523,679 1,583,932 561,078 509,331

Funded status $ (98,912)$(238,745)$(111,695)$ (154,495)

Amounts recognized in Consolidated Balance Sheets

Non-current asset $ 195 $ 175 $ 11,951 $ 530

Current liability (18,097)(7,456)(1,051)(967)

Non-current liability (81,010)(231,464)(122,595)(154,058)

Net amount recognized $(98,912)$(238,745)$(111,695)$ (154,495)