Pitney Bowes 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

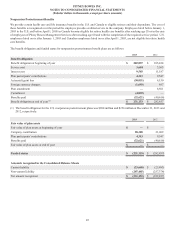

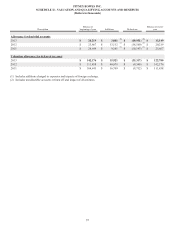

Exhibit 12

PITNEY BOWES INC.

COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES

(Dollars in thousands)

Years Ended December 31,

2013 2012 2011 2010 2009

Income from continuing operations

before income taxes $ 403,177 $ 534,312 $ 491,486 $ 458,992 $ 555,658

Add:

Interest expense (1) 195,836 196,368 203,061 203,911 208,855

Portion of rents representative of the

interest factor 22,259 22,564 25,893 25,270 27,064

Amortization of capitalized interest —973 1,535 1,716 1,716

Income as adjusted $ 621,272 $ 754,217 $ 721,975 $ 689,889 $ 793,293

Fixed charges:

Interest expense (1) $ 195,836 $ 196,368 $ 203,061 $ 203,911 $ 208,855

Portion of rents representative of the

interest factor 22,259 22,564 25,893 25,270 27,064

Noncontrolling interests (preferred

stock dividends of subsidiaries),

excluding taxes 27,841 27,841 27,507 29,790 32,851

Total fixed charges $ 245,936 $ 246,773 $ 256,461 $ 258,971 $ 268,770

Ratio of earnings to fixed charges (2) 2.53 3.06 2.82 2.66 2.95

(1) Interest expense includes both financing interest expense and other interest expense.

(2) The computation of the ratio of earnings to fixed charges has been computed by dividing income from continuing operations

before income taxes as adjusted by fixed charges. Included in fixed charges is one-third of rent expense as the representative

portion of interest.