Pitney Bowes 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

At December 31, 2013, there were no outstanding commercial paper borrowings. During the year, commercial paper borrowings averaged

$52 million at a weighted-average interest rate of 0.41% and the maximum amount outstanding at any time was $300 million. In 2012,

commercial paper borrowings averaged $221 million at a weighted-average interest rate of 0.39% and the maximum amount of commercial

paper outstanding at any point in time was $709 million.

In March 2013, we issued $425 million of 6.7% fixed-rate 30-year notes (net proceeds received after fees and discount were $412 million).

Interest is payable quarterly. The notes mature in 2043, but may be redeemed, at our option, in whole or in part, at any time on or after

March 7, 2018 at a redemption price equal to 100% of the principal amount, plus accrued and unpaid interest. The net proceeds were

used to fund the Tender Offer (see below).

In March 2013, we completed a cash tender offer (the Tender Offer) for a portion of the 4.875% Notes due 2014, the 5.0% Notes due

2015, and the 4.75% Notes due 2016 (the Subject Notes). Holders who validly tendered their notes received the principal amount of the

notes tendered, all accrued and unpaid interest and a premium payment. An aggregate $405 million of the Subject Notes were tendered.

In connection with this Tender Offer, we received $5 million from the unwind of certain interest rate swap agreements and recognized a

net loss of $25 million, consisting primarily of the premium payment.

In June 2013, the $375 million 3.875% notes matured and were redeemed with cash.

In November 2013, we redeemed the remaining $300 million of 4.875% outstanding notes that were scheduled to mature August 2014.

In connection with this redemption, we received $3 million from the unwind of an interest rate swap and recognized a loss of $8 million,

consisting primarily of a premium payment.

During 2012, we borrowed $230 million under term loan agreements. The term loans bear interest at the applicable London Interbank

Offered Rate (LIBOR) plus 2.25% or Prime Rate plus 1.25%, at our option. Interest is paid quarterly and the loans mature in 2015 and

2016. We also issued $110 million of 10-year notes with a coupon rate of 5.25%. Interest is paid quarterly and the notes mature in

November 2022. However, we may redeem some or all of the notes at any time on or after November 2015 at a redemption price equal

to 100% of the principal amount, plus accrued and unpaid interest. The proceeds from these issuances were for general corporate purposes,

including the repayment of 2013 debt maturities.

We have almost $2 billion of debt maturing in the next two to five years. While we fully expect to be able to fund these maturities through

cash redemptions or refinancing these maturities through the U.S. capital markets, these obligations could increase our vulnerability to

adverse market conditions, and impact our ability to refinance existing maturities.

Cash and cash equivalents held by our foreign subsidiaries were $392 million at December 31, 2013 and $219 million at December 31,

2012. Cash and cash equivalents held by our foreign subsidiaries are generally used to support the liquidity needs of these subsidiaries.

Most of these amounts could be repatriated to the U.S. but would be subject to additional taxes. Repatriation of some foreign balances

is restricted by local laws.

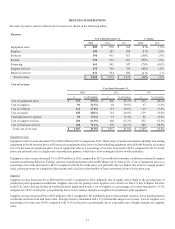

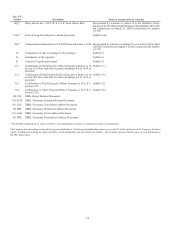

Contractual Obligations and Off-Balance Sheet Arrangements

The following summarizes our known contractual obligations and off-balance sheet arrangements at December 31, 2013 and the effect

that such obligations are expected to have on our liquidity and cash flow in future periods:

Payments due by period

Total Less than 1 year 1-3 years 3-5 years More than 5 years

Long-term debt $ 3,311 $ — $ 876 $ 1,100 $ 1,335

Interest payments on debt (1) 1,883 176 305 214 1,188

Non-cancelable operating lease obligations 201 56 73 37 35

Purchase obligations (2) 170 131 29 10 —

Pension plan contributions (3) 40 40—— —

Retiree medical payments (4) 195 24 44 40 87

Total $ 5,800 $ 427 $ 1,327 $ 1,401 $ 2,645

The amount and period of future payments related to our income tax uncertainties cannot be reliably estimated and are not included in

the above table. See Note 8 to the Consolidated Financial Statements for further details.