Pitney Bowes 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

81

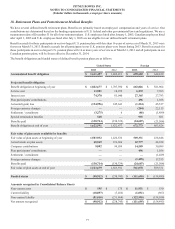

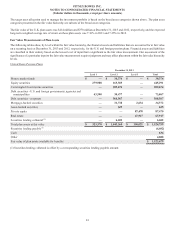

The target asset allocation used to manage the investment portfolio is based on the broad asset categories shown above. The plan asset

categories presented in the fair value hierarchy are subsets of the broad asset categories.

The fair value of the U.K. plan assets was $414 million and $370 million at December 31, 2013 and 2012, respectively, and the expected

long-term weighted average rate of return on these plan assets was 7.38% in 2013 and 7.25% in 2012.

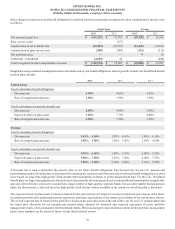

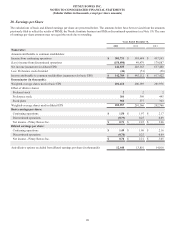

Fair Value Measurements of Plan Assets

The following tables show, by level within the fair value hierarchy, the financial assets and liabilities that are accounted for at fair value

on a recurring basis at December 31, 2013 and 2012, respectively, for the U.S. and foreign pension plans. Financial assets and liabilities

are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Our assessment of the

significance of a particular input to the fair value measurement requires judgment and may affect placement within the fair value hierarchy

levels.

United States Pension Plans

December 31, 2013

Level 1 Level 2 Level 3 Total

Money market funds $ — $ 30,374 $ — $ 30,374

Equity securities 279,988 165,303 — 445,291

Commingled fixed income securities — 209,674 — 209,674

Debt securities - U.S. and foreign governments, agencies and

municipalities 43,390 30,477 — 73,867

Debt securities - corporate — 568,567 — 568,567

Mortgage-backed securities — 31,738 2,634 34,372

Asset-backed securities — 625 — 625

Private equity — — 87,470 87,470

Real estate — — 67,917 67,917

Securities lending collateral (1) — 6,602 — 6,602

Total plan assets at fair value $ 323,378 $ 1,043,360 $ 158,021 $ 1,524,759

Securities lending payable (1) (6,602)

Cash 634

Other 4,888

Fair value of plan assets available for benefits $ 1,523,679

(1) Securities lending collateral is offset by a corresponding securities lending payable amount.