Pitney Bowes 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

53

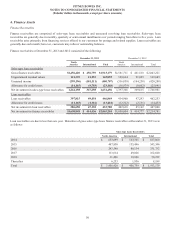

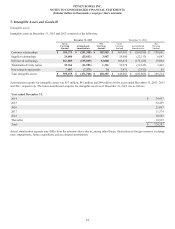

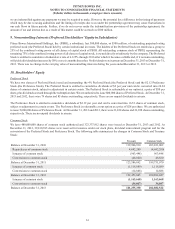

December 31,

2013 2012

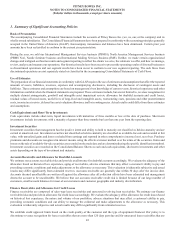

Sales-type lease receivables

Risk Level

Low $ 1,081,853 $ 1,016,413

Medium 244,379 450,432

High 51,851 43,658

Not Scored 78,337 71,208

Total $ 1,456,420 $ 1,581,711

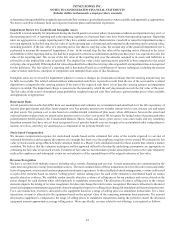

Loan receivables

Risk Level

Low $ 279,607 $ 254,567

Medium 95,524 136,069

High 11,511 14,624

Not Scored 11,173 9,700

Total $ 397,815 $ 414,960

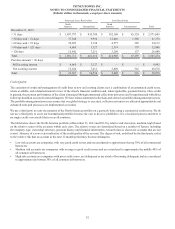

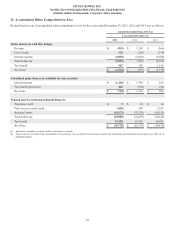

Troubled Debt

We maintain a program for U.S. clients in our North America loan portfolio who are experiencing financial difficulties, but are able

to make reduced payments over an extended period of time. Upon acceptance into the program, the client’s credit line is closed and

interest accrual is suspended. There is generally no forgiveness of debt or reduction of balances owed. The balance of loans in this

program, related loan loss allowance and write-offs are insignificant to the overall portfolio.

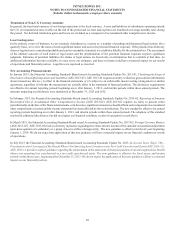

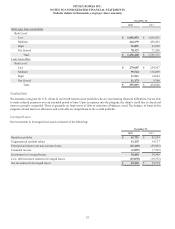

Leveraged Leases

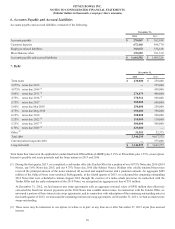

Our investment in leveraged lease assets consisted of the following:

December 31,

2013 2012

Rental receivables $ 61,721 $ 83,254

Unguaranteed residual values 13,235 14,177

Principal and interest on non-recourse loans (35,449)(55,092)

Unearned income (5,097)(7,793)

Investment in leveraged leases 34,410 34,546

Less: deferred taxes related to leveraged leases (15,078)(19,372)

Net investment in leveraged leases $ 19,332 $ 15,174