Pitney Bowes 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

66

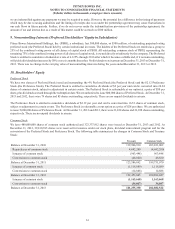

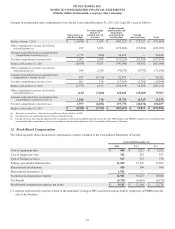

Employee Stock Purchase Plan

We maintain a non-compensatory Employee Stock Purchase Plan that enables substantially all U.S. and Canadian employees to purchase

shares of our common stock at an offering price of 95% of the average market price on the offering date. At no time will the exercise

price be less than the lowest price permitted under Section 423 of the Internal Revenue Code. Employees purchased 222,159 shares and

291,859 shares in 2013 and 2012, respectively. We have reserved 4,594,776 common shares for future purchase under the ESPP.

Directors' Stock Plan

Each non-employee director is granted shares of restricted stock on an annual basis. In 2013 and 2012, we granted 19,800 shares and

26,653 shares to non-employee directors, respectively.

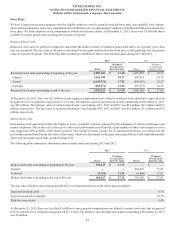

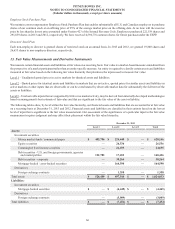

13. Fair Value Measurements and Derivative Instruments

We measure certain financial assets and liabilities at fair value on a recurring basis. Fair value is a market-based measure considered from

the perspective of a market participant rather than an entity-specific measure. An entity is required to classify certain assets and liabilities

measured at fair value based on the following fair value hierarchy that prioritizes the inputs used to measure fair value:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities.

Level 2 – Quoted prices for identical assets and liabilities in markets that are not active, quoted prices for similar assets and liabilities in

active markets or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the

assets or liabilities.

Level 3 – Unobservable inputs that are supported by little or no market activity, may be derived from internally developed methodologies

based on management's best estimate of fair value and that are significant to the fair value of the asset or liability.

The following tables show, by level within the fair value hierarchy, our financial assets and liabilities that are accounted for at fair value

on a recurring basis at December 31, 2013 and 2012. Financial assets and liabilities are classified in their entirety based on the lowest

level of input that is significant to the fair value measurement. Our assessment of the significance of a particular input to the fair value

measurement requires judgment and may affect their placement within the fair value hierarchy.

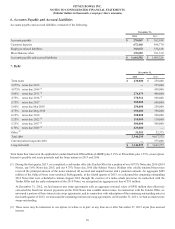

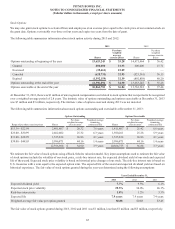

December 31, 2013

Level 1 Level 2 Level 3 Total

Assets:

Investment securities

Money market funds / commercial paper $ 403,706 $ 224,440 $ — $ 628,146

Equity securities — 26,536 — 26,536

Commingled fixed income securities — 24,695 — 24,695

Debt securities - U.S. and foreign governments, agencies

and municipalities 122,783 17,653 — 140,436

Debt securities - corporate — 38,264 — 38,264

Mortgage-backed / asset-backed securities — 164,598 — 164,598

Derivatives

Foreign exchange contracts — 1,358 — 1,358

Total assets $ 526,489 $ 497,544 $ — $ 1,024,033

Liabilities:

Investment securities

Mortgage-backed securities $—$

(4,445) $ — $ (4,445)

Derivatives

Foreign exchange contracts —(3,009) — (3,009)

Total liabilities $—$

(7,454) $ — $ (7,454)