Pitney Bowes 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

49

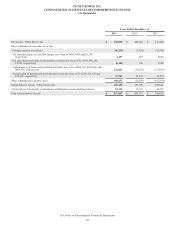

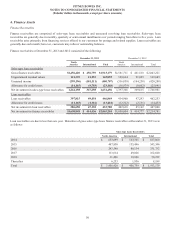

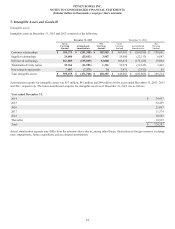

2. Inventories

December 31,

2013 2012

Raw materials and work in process $ 33,920 $ 66,221

Supplies and service parts 48,165 72,551

Finished products 38,515 68,335

Inventory at FIFO cost 120,600 207,107

Excess of FIFO cost over LIFO cost (17,020)(27,429)

Total inventory, net $ 103,580 $ 179,678

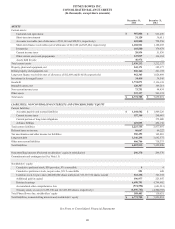

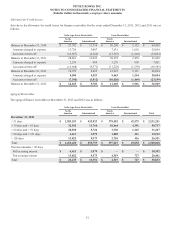

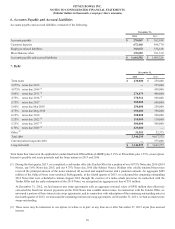

3. Fixed Assets

December 31,

2013 2012

Land $ 6,797 $ 22,064

Buildings 176,200 349,061

Machinery and equipment 918,075 1,299,475

1,101,072 1,670,600

Accumulated depreciation (855,901)(1,285,223)

Property, plant and equipment, net $ 245,171 $ 385,377

Rental property and equipment $ 537,128 $ 580,243

Accumulated depreciation (310,982)(339,051)

Rental property and equipment, net $ 226,146 $ 241,192

Depreciation expense was $158 million, $177 million and $195 million for the years ended December 31, 2013, 2012 and 2011,

respectively.

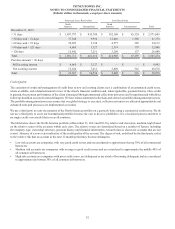

During 2013, we entered into an agreement to sell our corporate headquarters building and certain surrounding parcels of land. We

recorded a non-cash impairment charge of $26 million to write-down the carrying value of the building to its fair value. The fair value

of the building was determined based on the estimated selling price less the costs to sell. The inputs used to determine the fair value were

classified as Level 3. The impairment charge was included as restructuring charges and asset impairments in the Consolidated Statements

of Income. We expect to close on the sale by mid-2014. At December 31, 2013, the carrying value of our corporate headquarters building

and surrounding land were classified as assets held for sale in the Consolidated Balance Sheets.