Pitney Bowes 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

81

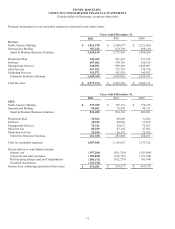

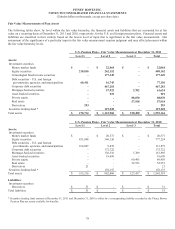

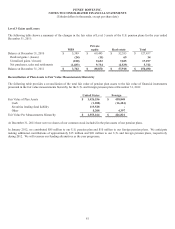

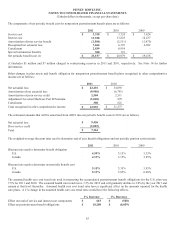

Level 3 Gains and Losses

The following table shows a summary of the changes in the fair value of Level 3 assets of the U.S. pension plans for the year ended

December 31, 2011:

MBS Private

equity Real estate Total

Balance at December 31, 2010 $ 5,389 $ 69,495 $ 52,553 $ 127,437

Realized gains / (losses) (24) (11) 69 34

Unrealized gains / (losses) (180) 9,652 7,825 17,297

Net purchases, sales and settlements (1,483) 9,734 (2,529) 5,722

Balance at December 31, 2011 $ 3,702 $ 88,870 $ 57,918 $ 150,490

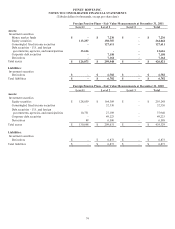

Reconciliation of Plan Assets to Fair Value Measurements Hierarchy

The following table provides a reconciliation of the total fair value of pension plan assets to the fair value of financial instruments

presented in the fair value measurements hierarchy for the U.S. and foreign pension plans at December 31, 2011:

United States Foreign

Fair Value of Plan Assets $ 1,426,536 $ 438,848

Cash (1,108) (16,424)

Securities lending fund liability 119,528 -

Other 8,208 4,397

Fair Value Per Measurements Hierarchy $ 1,553,164 $ 426,821

At December 31, 2011 there were no shares of our common stock included in the plan assets of our pension plans.

In January 2012, we contributed $85 million to our U.S. pension plan and $10 million to our foreign pension plans. We anticipate

making additional contributions of approximately $15 million and $20 million to our U.S. and foreign pension plans, respectively

during 2012. We will reassess our funding alternatives as the year progresses.