Pitney Bowes 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

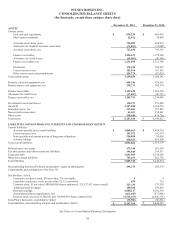

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

43

than the carrying amount, an impairment charge is recorded. The impairment charge is measured as the amount by which the carrying

amount exceeds the fair value of the asset. The fair value of the asset is determined using probability weighted expected cash flow

estimates, quoted market prices when available and appraisals, as appropriate.

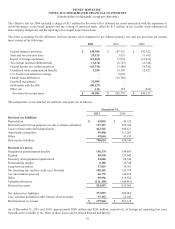

Retirement Plans

Actual pension plan results that differ from our assumptions and estimates are accumulated and amortized over the estimated future

working life of the plan participants and affect future pension expense. Net pension expense includes current service costs, interest

costs and returns on plan assets. Net pension expense is also based on a market-related valuation of plan assets where differences

between the actual and expected return on plan assets are amortized to pension expense over a five-year period. We recognize the

overfunded or underfunded status of pension and other postretirement benefit plans in the Consolidated Balance Sheets. Gains and

losses, prior service costs and credits, and any remaining transition amounts that have not yet been recognized in net periodic benefit

costs are recognized in accumulated other comprehensive income, net of tax, until they are amortized as a component of net periodic

benefit cost. We use a measurement date of December 31 for all of our retirement plans.

The Board of Directors has approved and adopted a resolution amending the U.S. pension plans to provide that benefit accruals as of

December 31, 2014 will be determined and frozen and no future benefit accruals under the plans will occur after that date.

Stock-based Compensation

We measure compensation cost for stock-based awards based on the estimated fair value of the award, and recognize the cost as an

expense on a straight-line basis (net of estimated forfeitures) over the employee requisite service period. We estimate the fair value of

stock options using a Black-Scholes valuation model.

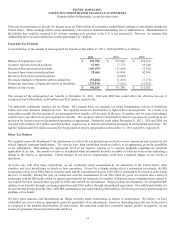

Revenue Recognition

We derive our revenue from multiple sources including sales, rentals, financing, and services. Certain of our transactions are

consummated at the same time and generate revenue from multiple sources. The most common form of these transactions involves

the sale or non-cancelable lease of equipment, a meter rental and an equipment maintenance agreement. In these multiple element

arrangements, revenue is allocated to each of the elements based on their relative fair values. The allocation of fair values to the

various elements does not change the total revenue recognized from a transaction, but impacts the timing of revenue recognition.

Revenue is allocated to the meter rental and equipment maintenance agreement elements using their respective fair values, which are

determined based on prices charged in standalone and renewal transactions. For a sale transaction, revenue is allocated to the

equipment based on a range of selling prices in standalone transactions. For a lease transaction, revenue is allocated to the equipment

based on the present value of the remaining minimum lease payments. We then compare the allocated equipment fair value to the

range of selling prices in standalone transactions during the period to ensure the allocated equipment fair value approximates average

selling prices. More specifically, revenue related to our offerings is recognized as follows:

Sales Revenue

Sales of Equipment

We sell equipment to our customers, as well as to distributors (re-sellers) throughout the world. We recognize revenue from these

sales when the risks and rewards of ownership transfer to the customer, which is generally upon shipment. We recognize revenue

from the sale of equipment under sales-type leases as equipment revenue at the inception of the lease. We do not typically offer any

rights of return or stock balancing rights. Sales revenue from customized equipment, mail creation equipment and shipping products

is generally recognized when installed.

Sales of Supplies

Revenue related to supplies is recognized at the point of title transfer, which is generally upon shipment.

Standalone Software Sales and Integration Services

We recognize revenue from standalone software licenses upon delivery of the product when persuasive evidence of an arrangement

exists, delivery has occurred, the fee is fixed and determinable and collectability is probable. For software licenses that are included in

a lease contract, we recognize revenue upon shipment of the software unless the lease contract specifies that the license expires at the

end of the lease or the price of the software is deemed not fixed or determinable based on historical evidence of similar software

leases. In these instances, revenue is recognized on a straight-line basis over the term of the lease contract. We recognize revenue

from software requiring integration services at the point of customer acceptance. We recognize revenue related to off-the-shelf

perpetual software licenses upon transfer of title, which is generally upon shipment.