Pitney Bowes 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

56

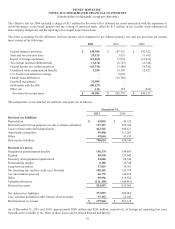

stock-based compensation awards require a minimum requisite service period of one year for retirement eligible employees to vest.

At December 31, 2011, there were 16,903,013 shares available for future grants under our stock plans.

Stock Options

Under our stock option plan, certain officers and employees are granted options at prices equal to the market value of our common

shares at the date of grant. Options granted in 2008 generally become exercisable in four equal installments during the first four years

following their grant and expire ten years from the date of grant. Options granted on or after 2009 generally become exercisable in

three equal installments during the first three years following their grant and expire ten years from the date of grant.

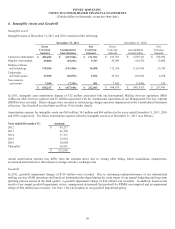

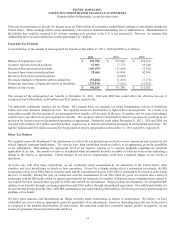

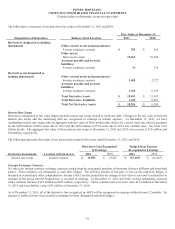

The following tables summarize information about stock option activity during 2011:

Shares

Per share

weighted-

average exercise

price

Options outstanding at December 31, 2010 14,506,522 $37.38

Granted 1,312,910 $26.07

Exercised (55,484) $25.15

Cancelled (1,266,537) $37.61

Forfeited (25,947) $27.27

Options outstanding at December 31, 2011 14,471,464 $36.42

Options exercisable at December 31, 2011 11,478,630 $39.13

The options exercisable at December 31, 2011 had no intrinsic value. The intrinsic value of options exercised in 2011 was less than

$1 million. No options were exercised during 2010 and 2009.

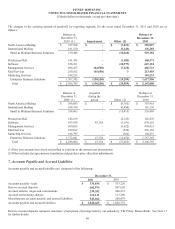

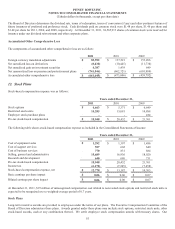

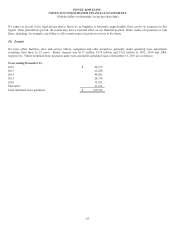

The following table summarizes information about stock options outstanding and exercisable at December 31, 2011:

Options Outstanding Options Exercisable

Range of per

share exercise

prices Number

Per share

weighted-

average

exercise

price

Weighted-

average

remaining

contractual

life Number

Per share

weighted-

average

exercise

price

Weighted-

average

remaining

contractual

life

$22.09 - $30.99 3,986,021 $24.23 8.0 years 1,370,704 $23.78 7.4 years

$31.00 - $36.99 3,207,738 $34.71 3.6 years 2,830,221 $34.42 3.3 years

$37.00 - $42.99 3,842,311 $41.12 2.4 years 3,842,311 $41.12 2.4 years

$43.00 - $48.03 3,435,394 $46.90 4.7 years 3,435,394 $46.90 3.7 years

14,471,464 $36.42 4.5 years 11,478,630 $39.13 3.6 years

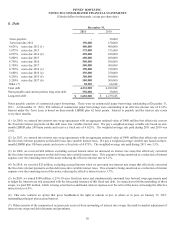

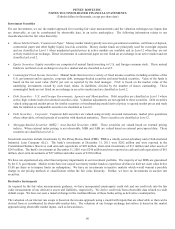

We estimate the fair value of stock options using a Black-Scholes valuation model. Key input assumptions used to estimate the fair

value of stock options include the volatility of our stock, the risk-free interest rate and our dividend yield. Our estimates of stock

volatility are based on historical price changes of our stock. The risk-free interest rate is based on U.S. treasuries with a term equal to

the expected option term. The expected life, or holding period, of the award is based on historical experience.

We believe that the valuation technique and the approach utilized to develop the underlying assumptions are appropriate in estimating

the fair value of our stock option grants. Estimates of fair value are not intended to predict actual future events or the value ultimately

realized by employees who receive equity awards, and subsequent events are not indicative of the reasonableness of the original

estimates of fair value.