Pitney Bowes 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

68

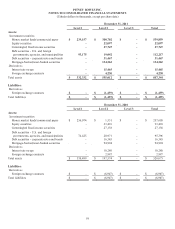

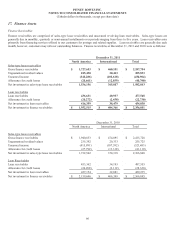

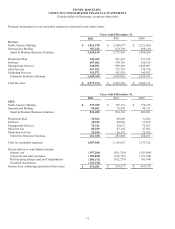

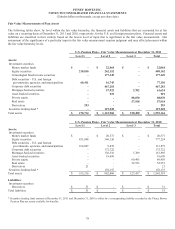

The aging of gross finance receivables at December 31, 2011 and 2010 was as follows:

Sales-type Lease Receivables Loan Receivables

North

America International

North

America International Total

December 31, 2011

< 31 days past due $ 1,641,706 $ 434,811 $ 414,434 $ 38,841 $ 2,529,792

> 30 days and < 61 days 41,018 10,152 12,399 1,066 64,635

> 60 days and < 91 days 24,309 5,666 4,362 425 34,762

> 90 days and < 121 days 4,912 3,207 2,328 186 10,633

> 120 days 15,708 6,265 3,108 419 25,500

TOTAL $ 1,727,653 $ 460,101 $ 436,631 $ 40,937 $ 2,665,322

Past due amounts > 90 days

Still accruing interest $ 4,912 $ 3,207 $ - $ - $ 8,119

Not accruing interest 15,708 6,265 5,436 605 28,014

TOTAL $ 20,620 $ 9,472 $ 5,436 $ 605 $ 36,133

December 31, 2010

< 31 days past due $ 1,831,655 $ 447,459 $ 430,042 $ 32,389 $ 2,741,545

> 30 days and < 61 days 45,234 10,018 12,081 1,149 68,482

> 60 days and < 91 days 29,380 4,743 4,711 325 39,159

> 90 days and < 121 days 8,654 3,985 2,712 192 15,543

> 120 days 25,910 8,690 3,816 138 38,554

TOTAL $ 1,940,833 $ 474,895 $ 453,362 $ 34,193 $ 2,903,283

Past due amounts > 90 days

Still accruing interest $ 8,654 $ 3,985 $ - $ - $ 12,639

Not accruing interest 25,910 8,690 6,528 330 41,458

TOTAL $ 34,564 $ 12,675 $ 6,528 $ 330 $ 54,097

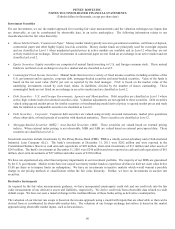

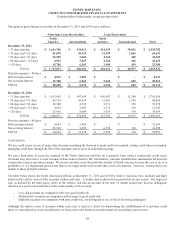

Credit Quality

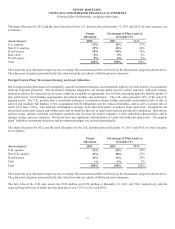

We use credit scores as one of many data elements in making the decision to grant credit at inception, setting credit lines at inception,

managing credit lines through the life of the customer, and to assist in collections strategy.

We use a third party to score the majority of the North American portfolio on a quarterly basis using a commercial credit score.

Accounts may not receive a score because of data issues related to SIC information, customer identification mismatches between the

various data sources and other reasons. We do not currently score the portfolios outside of North America because the cost to do so is

prohibitive, it is a fragmented process and there is no single credit score model that covers all countries. However, credit policies are

similar to those in North America.

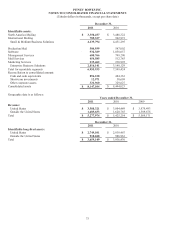

The table below shows the North American portfolio at December 31, 2011 and 2010 by relative risk class (low, medium and high)

based on the relative scores of the accounts within each class. A fourth class is shown for accounts that are not scored. The degree of

risk, as defined by the third party, refers to the relative risk that an account in the next 12 month period may become delinquent.

Absence of a score is not indicative of the credit quality of the account.

- Low risk accounts are companies with very good credit risk

- Medium risk accounts are companies with average to good credit risk

- High risk accounts are companies with poor credit risk, are delinquent or are at risk of becoming delinquent

Although the relative score of accounts within each class is used as a factor for determining the establishment of a customer credit

limit, it is not indicative of our actual history of losses due to the business essential nature of our products and services.