Pitney Bowes 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

46

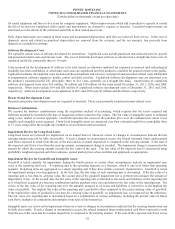

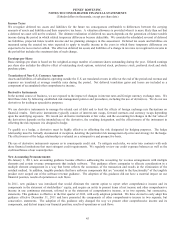

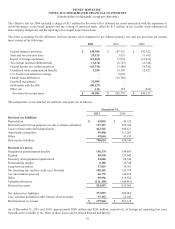

2. Discontinued Operations

During 2011, we entered into a series of settlements with the IRS in connection with their examinations of our tax years 2001-2008.

We agreed upon both the tax treatment of a number of disputed issues, including issues related to our Capital Services business that

was sold in 2006, and revised tax calculations. As a result of these settlements, an aggregate $264 million benefit was recognized in

discontinued operations.

The net loss in 2010 and 2009 includes the accrual of interest on uncertain tax positions and additional tax associated with the

discontinued operations. The net loss in 2009 also includes after-tax income of $6 million for a bankruptcy settlement and $7 million

related to the expiration of an indemnity agreement associated with the sale of a former subsidiary.

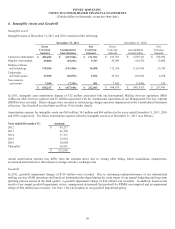

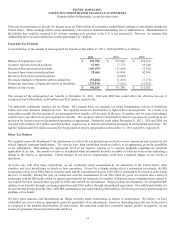

3. Acquisitions

There were no acquisitions during 2011 or 2009.

In July 2010, we acquired Portrait Software plc (Portrait) for $65 million in cash, net of cash acquired. Portrait provides software to

enhance existing customer relationship management systems, enabling clients to achieve improved customer retention and

profitability. The allocation of the purchase price to the fair values of the assets acquired and liabilities assumed is shown below. The

primary items that generated goodwill are the anticipated synergies from the compatibility of the acquired technology with our

existing product and service offerings, and employees of Portrait, neither of which qualify as an amortizable intangible asset. None of

the goodwill will be deductible for tax purposes.

Purchase price allocation:

Current assets $ 7,919

Other non-current assets 6,940

Intangible assets 31,332

Goodwill 42,766

Current liabilities (13,014)

Non-current liabilities (10,793)

Purchase price, net of cash acquired $ 65,150

During 2010, we also completed smaller acquisitions for aggregate cash payments of $12 million. These acquisitions did not have a

material impact on our financial results.

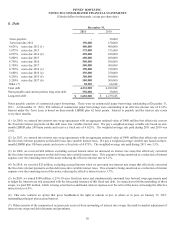

The Consolidated Financial Statements include the results of operations of the acquired businesses from their respective dates of

acquisition. Assuming these acquisitions occurred on January 1, 2010 and 2009, total pro forma revenue would have been $5,452

million and $5,620 million for 2010 and 2009, respectively. The pro forma earnings results of these acquisitions were not material to

net income or earnings per share. The pro forma consolidated amounts do not purport to be indicative of actual results that would

have occurred had the acquisitions been completed on January 1, 2010 and 2009, nor do they purport to be indicative of the results

that will be obtained in the future.